Relevant Posts

Global Markets

Satellite Broadband Development in the Philippines

Satellite Broadband Development in the Philippines

Actionable Strategies signed an agreement with WIT Philippines to develop a next generation satellite broadband project. As a result of a 2022 agreement between Presidents Joko Widodo of Indonesia and Ferdinand Marco, Jr. of the Philippines, Pasifik Satelit Nustara 5 will provide the first dedicated allocation of satellite bandwidth to the Philippines. PSN5 will be launched on a SpaceX Falcon 9 rocket later this year.

WIT will be using this capacity to improve access to broadband in the Philippines. This next generation of technology will increase capacity in the country by more than 150%. It will dramatically lower the cost to customers making the average cost from current providers 85% higher.

As an archipelago of 7,741 islands, the Philippines has radically lower Internet penetration than ASEAN and other neighboring countries. Satellite is the only practical way to reach many of the 42,036 villages of which 10,875 are designated as Geographically Isolated and Disadvantaged Areas (GIDAs).

By helping the Government of the Philippines meet its universal service obligations, the project will advance economic development and improve equality for the disadvantaged. Telemedicine and distance learning objectives have been constrained by lack of Internet access. This project will immediately accelerate the delivery of healthcare and education, driving long-term outcomes across all age groups.

GIDAs are more vulnerable to frequent typhoons and earthquakes. Solar-powered earth stations with battery energy storage deliver a resilient and sustainable infrastructure that aids in emergency response.

We are proud to play a small part in using pragmatic strategies and advanced technology to improve livelihoods and drive competition.

Congratulations to Prince Dr. Dapo Abiodun for receiving the Forbes award for Best African Governor

Actionable Strategies’ CEO Jeffrey Wu was asked to congratulate Prince Dr. Dapo Abiodun for receiving the Forbes award for Best African Governor leading the new Industrial Revolution. His work as governor of Ogun State in Nigeria has been recognized by Forbes, but he has received a number of awards in the recent past for promoting education, agriculture, and security.

The Governor has supported diverse initiatives including advancements in information and communications technologies, urban renewal, agriculture, and transportation. The results for Ogun State have been demonstrable and benefit a broad range of stakeholders.

Governor Abiodun has fostered a favorable business climate in Ogun which has helped attract foreign investment. The state has achieved significant economic growth and both results benefit all Nigerians.

By proactively including micro and small businesses, Governor Abiodun is driving a broad economic base. An inclusive economy is essential in Africa given the large number of participants in the informal economy. Bringing thousands of women into the workforce and economy has fueled further expansion across sectors.

Africa needs leaders who drive self-sufficiency by fostering education, private sector development, workforce inclusion, and local competition. My hope for the continent is that the vast and growing pools of human capital can be unleashed in a modern economy for the betterment of all.

Support for Private Sector at Indo-Pacific Business Forum

Support for Private Sector at Indo-Pacific Business Forum

At today’s Indo-Pacific Business Forum, senior government officials universally expressed their support for the private sector in advancing shared interests in the region. Secretary of Commerce Gina Raimondo, Secretary of State Antony Blinken, and Secretary of Transportation Pete Buttigieg spoke about how private enterprises can advance economic and social development in a responsible fashion.

USTDA Director Enoh Ebong and DFC CEO Scott Nathan were among the speakers who discussed financial support for impactful initiatives. Actionable Strategies has worked with both organizations and found them to be focused on measurable results with governance that strives to ensure that funding is used effectively. It is quite refreshing to see the public sector allocate capital efficiently while demanding accountability.

Congratulations to Gambian President Adama Barrow

The Foreign Investment Network asked Actionable Strategies’ CEO Jeffrey Wu to congratulate Gambian President Adama Barrow for an award for attracting foreign direct investment. Unfortunately, President Barrow was unable to travel to receive the award due to security concerns related to a failed coup attempt.

During his term, President Barrow oversaw an increase in economic growth from an anemic 1% to 5% despite the dramatic impact of COVID. He slashed interest rates with treasury instruments falling from 23% to 4%.

Fiscally, major projects provided jobs and growth in key economic sectors including energy, healthcare, and transportation. Human capital development for Gambian youth included a focus on STEM education.

Supporting the private sector across industries will lead to greater prosperity and opportunities for the citizens of Gambia. It is my personal hope that Africans can continue to mobilize their talent and drive towards self-sufficiency.

The award from the Foreign Investment Network was well-deserved.

Youth in Emerging Markets

Youth in Emerging Markets

With “Davos in the Desert” in full swing, there is a subtle driver for attracting foreign direct investment that is often overlooked. Saudi Arabia realizes there is a risk of radicalization of the growing young population who cannot find jobs they consider attractive. Showering youth with handouts or providing make-work government jobs will become economically non-viable and fails to develop domestic human capital.

When interviewed by the Foreign Investment Network, Actionable Strategies’ CEO Jeffrey Wu stated that we ignore Africa as an investment opportunity at our own peril. There are meaningful political and security risks if we fail to develop the continent. By 2050, one-quarter of all people in world will be African which is the classic double-edged sword.

As Western birthrates decline, Africa has the opportunity to fill future demand for workers, both on the continent and around the world. Failing to develop the skills needed for young workers to succeed in a modern economy places countries at risk of radicalization. Hopeless youth have turned to violence in the past across global markets. The Saudis are proactively trying to avoid this outcome.

Foreign direct investment plays a critical role in this scenario. While African countries must develop local talent, this supply of labor must be put to work. FDI can create jobs for skilled labor, providing returns for investors but also developing a middle class.

Consumerism adds to economic growth which then creates additional jobs and drives growth of a service sector. The multiplier effect is the great promise, but inertia is difficult to overcome.

UN Global Compact

UN Global Compact

Prior to the UN General Assembly meeting, Secretary General António Guterres gave a speech to the Global Compact. Discussing the need for investment in Africa, Secretary General Guterres called the game rigged. While capital flow to Africa is highly constrained, Actionable Strategies’ experience in finding project finance for clients is that the situation is more nuanced.

Lack of political and monetary unions, CFA franc aside, increases the overhead required for investor due diligence. While some harmonization has been implemented, cross-border friction hampers business scalability and therefore limits upside potential for growth businesses such as those in the tech sector.

Developing products and services for a fractured marketplace increases complexity and cost. Operating costs must be tightly controlled: sales, distribution, and service organizations must be more flexible and optimized to contain costs.

In addition to the concerns over corruption, investors are also wary of political instability. Political risk insurance, if available, tends to be very expensive. Uncertainty over policy shifts increases investment risk especially for capital intensive projects. While this is true in all markets, risk premiums in emerging markets tend to be higher with less stable and more opaque countries.

Currency risk can often be hedged but foreign exchange forwards contracts can be expensive.

Africa has a growing population averaging 20 years old compared to 30 for the world and 39 in the U.S. While this supply of labor can fuel future growth, the limited availability of executive, managerial, and technical talent constrains growth and current economic development.

Absent collusion or artificial barriers, capital generally flows freely across borders. In my opinion, the game is not rigged against Africa, but investors face challenges in identifying promising opportunities with the appropriate risk/reward profile. Opportunities are abundant in Africa but need to be sought after. Investors can realize outsized returns while helping the continent develop and contribute to global economic growth.

New York Stock Exchange Economic Forum

New York Stock Exchange Economic Forum

Prior to addressing the UN General Assembly today, Philippines President Ferdinand Marcos, Jr. addressed the New York Stock Exchange Economic Forum where he later rang the closing bell. He discussed lower corporate tax rates, policies to liberalize the economy, and attracting additional investment.

“Bongbong” was introduced by NYSE Vice Chairman John Tuttle.

“In addition to touting the strength and resilience of the economy, President Marcos stressed the strength of the partnership with the United States. Noted areas of growth included IT services, EVs and batteries, business process outsourcing, telecommunications, medical products, and agriculture.

While not covered prominently in the press, I noted an important topic when I attended his speech. Using carefully measured language, President Marcos stated our shared concerns about our joint interests in the region. Mentioning other countries with similar situations, he was obliquely pointing out the direct and looming threats posed by China. I share his concern and foresee greater aggression, both active and passive, as the world grows more dependent upon China for everything from components using rare earths to critical goods such as medical supplies.

Business leaders need to assess the risk and potential long-term costs associated with dependence on supply chains based in authoritarian regimes. Revocation of freedoms, seizure of assets, and imprisonment of dissenting leaders are real risks that can occur with frightening speed and with little to no warning. Without legal or moral recourse, it is incumbent upon business leaders to plan for these real possibilities.”

Global Africa Business Initiative

Global Africa Business Initiative

The United Nations Global Compact kicked off the Global Africa Business Initiative yesterday in New York. In the Global Compact, CEOs and their boards commit to implement sustainability principles and operate in a socially responsible manner.

The Global Africa Business Initiative discussed pragmatic ways for companies to develop business in Africa while promoting sustainable economic development. Issues such as infrastructure development, education and human capital building, corruption, and cross-border harmonization/collaboration were covered.

Actionable Strategies’ CEO Jeffrey Wu joined heads of state, senior government officials, and business leaders to discuss practical approaches to promote economic growth without exploiting the continent or destroying the environment. With Africa projected to represent a quarter of the world’s population by 2050, free trade and developing a more wealthy and educated market create opportunities for those committed to democratic principles and free competition.

Actionable Strategies will continue to work with clients on the continent to see this vision realized.

Business Recovery Lessons

In discussions with Actionable Strategies, Chinese business leaders provided a number of lessons they have learned as they recovered their businesses from lockdown.

Omnichannel

Omnichannel is now imperative for any business that sells to consumers. During lockdown, online touchpoints were essential for survival. Consumer behavior will be permanently altered for some percentage of customers. Comfort and familiarity with an online, low-touch model will require continued focus on this model. This is not a new phenomenon. For example, financial services has experienced a number of revolutionary disruptions such as the original disintermediation from the ATM, online banking and electronic trading. The solution has always been to adjust the channel mix and continue to engage customers as they choose.

Omnichannel is now imperative for any business that sells to consumers. During lockdown, online touchpoints were essential for survival. Consumer behavior will be permanently altered for some percentage of customers. Comfort and familiarity with an online, low-touch model will require continued focus on this model. This is not a new phenomenon. For example, financial services has experienced a number of revolutionary disruptions such as the original disintermediation from the ATM, online banking and electronic trading. The solution has always been to adjust the channel mix and continue to engage customers as they choose.

Relationships

Chinese have historically placed great value on relationships and this remains true today. Relationships are often built over social interactions such as dining, drinking, golf and high-touch other activities. These have now become more important as social distancing and the risks associated with COVID-19 make face-to-face meetings less compelling. Chinese business leaders stated that actively maintaining networks through in-person contact is key to future success when dealing with other companies.

Chinese have historically placed great value on relationships and this remains true today. Relationships are often built over social interactions such as dining, drinking, golf and high-touch other activities. These have now become more important as social distancing and the risks associated with COVID-19 make face-to-face meetings less compelling. Chinese business leaders stated that actively maintaining networks through in-person contact is key to future success when dealing with other companies.

Direct-to-Consumer

As with omnichannel, direct-to-consumer is a reality. With disruptions in distribution, some sellers sought to bypass intermediaries and sell directly to consumers. A striking example is “farm to table” where 13 million farmers now sell produce directly to consumers. These sales were facilitated by e-commerce platforms such as Alibaba’ Taobao, JD.com and Pinduoduo which fulfilled over 1 billions orders in the first quarter alone.

As with omnichannel, direct-to-consumer is a reality. With disruptions in distribution, some sellers sought to bypass intermediaries and sell directly to consumers. A striking example is “farm to table” where 13 million farmers now sell produce directly to consumers. These sales were facilitated by e-commerce platforms such as Alibaba’ Taobao, JD.com and Pinduoduo which fulfilled over 1 billions orders in the first quarter alone.

Virtual Work

Working from home will continue to be an important aspect of the human capital management landscape. Not every worker will return to their office space every day. While this is part of the gradual return-to-work model, some portion of the workforce will continue to work from home for part of the work day or potentially in perpetuity. Again, this is nothing new. For consulting organizations and other knowledge workers, it has been common to gather in person for critical face-to-face meetings and work remotely at other times.

Working from home will continue to be an important aspect of the human capital management landscape. Not every worker will return to their office space every day. While this is part of the gradual return-to-work model, some portion of the workforce will continue to work from home for part of the work day or potentially in perpetuity. Again, this is nothing new. For consulting organizations and other knowledge workers, it has been common to gather in person for critical face-to-face meetings and work remotely at other times.

Transmission Avoidance

The damage caused by lockdown was serious on many levels but did reduce the mortality and infection rates. Aside from personal consequences, there were severe business impacts felt across almost all industries. Business leaders in China have universally advised following practices that avoid the spread and resurgence of COVID-19.

New Normal

The new normal has not been realized yet. Behaviors and practices will continue to evolve as societies and the medical community move forward to address the issues posed by a novel virus. One thing is certain: the virus accelerated trends that were already in place with digital transformation, virtual engagement of teams and customers, and global risk management.

Lessons From Financial Services About Mitigating Supply Chain Risks

During discussions with supply chain executives, CEO Jeffrey Wu proposed applying a model from financial services. It was viewed as a viable and appropriate approach for a number of industries.

After sharing ideas about protection of supply chains with some manufacturing executives, I received feedback that it was valuable. Hopefully you will, too. We can apply a lesson learned in the financial crisis to manage supply chain risk. Firms had used a prime broker which concentrated counterparty risk to a single entity. The crisis forced them to transition to multi-prime to minimize risk.

After sharing ideas about protection of supply chains with some manufacturing executives, I received feedback that it was valuable. Hopefully you will, too. We can apply a lesson learned in the financial crisis to manage supply chain risk. Firms had used a prime broker which concentrated counterparty risk to a single entity. The crisis forced them to transition to multi-prime to minimize risk.

With the current crisis, supply chain executives are considering moving out of China and possibly homeshoring, but this still concentrates risk. Given the disruption involved, it is timely to consider adopting a multi-source supply chain, even with the great complexity involved. The foundation includes distributed Lean processes in multiple countries, possibly using safety stocks, and a robust technology infrastructure supporting situational awareness. Correlated risks should be avoided in selecting potential partner sites.

This approach applies even more naturally to BPO, software development, support and other services. Incremental costs can be minimized if processes are harmonized and managed globally. Management should include tight governance as exercised over other critical infrastructure vendors. Some forward thinking leaders I spoke with agree and are already pursuing this approach.

Strategy

The Metaverse is Nothing New

The Metaverse is Nothing New

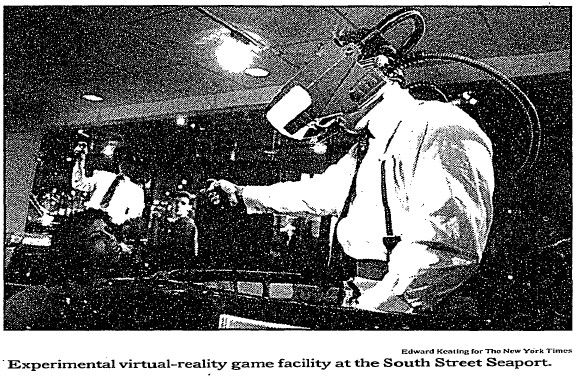

The metaverse is already over 30 years old. In 1992, I appeared in a New York Times article about virtual reality (VR) in New York City. As with any hyped tech, if there is a business case or personal reason to embrace the concept then do so. If there is no reason to interact in a persistent, virtual world then you will probably see no value in the metaverse at the moment.

William Gibson first coined the term cyberspace in 1982. His 1984 novel, Neuromancer, described a direct connection between the mind and cyberspace. Since then, virtual worlds have arisen fit to different purposes.

VR gaming led to Augmented Reality such as the popular Pokémon Go released in 2016.

I owned an early Oculus headset before they were bought by Facebook in 2014. In addition to playing games, I found it interesting to take virtual tours of distant places. The human-machine interfaces (rendering resolution, sensors, facial recognition) and physical form have improved dramatically but not to the point where I would choose to spend hours in VR over real life. In an article today, also in the New York Times, Brian X. Chen argues that gaming remains the only real mass market use case at the moment.

There are other use cases that have been in practical use without the hype of vendors trying to create a market. Similar to gaming, simulators have existed for decades. Far beyond the early PC-based flight simulators, the Smithsonian in Washington DC has a simulator that is highly immersive which allows you to dogfight upside down and perform barrel rolls. The practical use of simulators dates back to the space program in the 1950s and are an integral part of training in complex and costly environments.

Digital twins, virtual representations of the real-world generally updated in real-time via sensors, are used in applications in many industrial sectors. This use case enables people to interact with environments that are complex, dangerous, massively scaled or otherwise difficult to manipulate in the physical world. Digital twins also enable deployment of specialized human capital expertise without the need to travel to the physical sites involved.

Businesses need a metaverse strategy if this is where they will interact with customers, internal operations, or their supply chains. There are real opportunities for certain enterprises. However, just because a company can do something, does not mean that it should. Embrace technologies that provide a strategic or competitive advantage; otherwise, preserve capital and management focus on those initiatives that drive real value.

Today’s Playbook for Tomorrow’s Transformation

Today’s Playbook for Tomorrow’s Transformation

After speaking at The Economist’s event Today’s Playbook for Tomorrow’s Transformation, former Goldman Sachs Chairman and CEO Lloyd Blankfein discussed deglobalization with Actionable Strategies’ CEO Jeffrey Wu. They shared concerns about the growing threats from China. When he talked about his previous hopes for greater cooperation fostered by economic ties not coming to fruition, Lloyd was witty as ever with the Yogi Berra tribute – “the present is hard enough to predict, let alone the future”.

Mr. Blankfein talked about deglobalization as the future because we mistakenly believed that China would embrace democratic ideals as they emerged from poverty after the Great Leap Forward. My dealings there led me to this conclusion last decade. My take is that the systems and ideologies were always diametrically opposed but rather than converge, they are becoming more conflicted.

Unfortunately, China has been explicit about assuming a dominant position in the world, taking over Taiwan, and taking revenge for the “century of humiliation”. What we view as ancient history, they view as the very recent past.

The opening theme of his talk pointed out that everything involves technology in some fashion and we shouldn’t view it separately. Rather, tech is an integral part of everything we do but does drive disruption and “all change is tough”.

The closing topic was ESG. He discussed always trying to be on the right side of issues, despite criticism. With ESG, he advocated pragmatism and doing cost-benefit analysis to choose the best paths forward especially when there are unintended consequences. “All times are complicated. Only after you’ve lived through them do they seem simple.” He noted that ESG can be onerous and exasperated by regulators who are not focused on the practical implementation issues. He stated the “profile of a CEO is different” today and they must take action.

As usual, I found Lloyd to be understated, insightful, and advocating a pragmatic course of action with a broader view and strategic lens.

Thoughtful Digital Transformation

In an interview about Thoughtful Digital Transformation, Actionable Strategies’ CEO Jeffrey Wu shared that technology is not the constraint: success is predicated on clear vision and aspirations for transformation along with effective change management of impacted processes and organizational responsibilities.

Forrester’s Rob Koplowitz noted the many failures of Chief Digital Officers which Jeffrey ascribes to reliance on technology over using a well-defined strategy for the targeted markets, customers and products/services that will result from transformation.

Strategic Planning during Heightened Uncertainty

The global pandemic has created hardship and strain on people around the globe. This pressure impacts the organizations where people work and companies who provide goods and services in virtually every market. Since we are still learning about the characteristics of this novel virus, the level of uncertainty remains extremely high.

We will examine some of the more prominent planning considerations in this tumultuous environment.

Recovery Uncertainty

While recovery is in progress, the path could take many shapes and varying trajectories. Variance in recovery scenarios also includes the time horizon. Strategic planning under these circumstances is difficult but not impossible. Leaders should learn from past situations and adapt working models to suit their specific situation. This includes the potential for recurring outbreaks as changes in weather and behavior reintroduce risk.

Transformed Business Models

Shutting down large swaths of the economy will have lasting impacts across industries.

Digital channels: Accelerated movement of customers to digital channels may abate, but many businesses will see Internet touchpoints remain the preferred channels.

Human capital: Human capital management will change as some portion of the workforce will continue to work from home either permanently or more frequently than prior to the pandemic.

Supply chains: Shifts in supply chains take longer to enact but are already underway.

Evolutionary disruption: Many of the changes being witnessed will not be permanent. Evolution of channel mix, reversion to a more hybrid workplace model, increased customer and visitor density in public places, and other inevitable changes will occur as the responses to the virus eventually take effect.

Political Uncertainty

Given the number of factors that might impact strategic initiatives, waiting until the annual planning cycle this year might be too late for many organizations. In addition to the pandemic, companies may be subjected to change related to the U.S. presidential elections. A Biden presidency will definitely introduce change, but another Trump term will also alter the posture of the administration as it no longer has to worry about another election. However, any lame duck moves may be curtailed by change of control in the Senate.

Regional and local politics may also impact some businesses. For companies with operations in many jurisdictions, the myriad of localized regulations dwarf national ones. Navigating conflicting regulations can be a daunting task. Compounding this complexity is the self-regulation related to ESG initiatives and progress reporting.

Return of ESG

Environmental, social and governance agendas have momentarily lost prominence due to the global pandemic. However, the underlying concerns remain and will not relent. Calls for social justice are already helping re-elevate ESG as a strategic consideration. Without clear frameworks for reporting, ESG initiatives require strategic direction and organizational alignment to ensure that companies are regarded as responsible and proactive.

Strategic Planning Imperative

A well formulated and achievable strategic plan is an immediate imperative as most companies approach a new calendar and fiscal year. Subsequently, execution must continue to monitor and adapt to market forces to be effective. A Harvard Business Review article noted that many “executives fail to execute strategy because they’re too internally focused”. For example, they may “lack depth in their competitive context” and fail to adapt as their competitors execute their strategies. Starting with a broad view of the market landscape is essential to enable execution to succeed.

Virtual Work Environments – Panel Appearance

Creating a virtual work environment is a leadership challenge that should be managed. Being productive at home involves controlling yourself as well as your environment.

Through the SIM Community Outreach Committee, I am coaching for NPower who helps “launch digital careers for military veterans and young adults from underserved communities”. Last week, I was on a panel about virtual work. Having first worked remotely in the 1980s, I wanted to share what helped me achieve the most.

Through the SIM Community Outreach Committee, I am coaching for NPower who helps “launch digital careers for military veterans and young adults from underserved communities”. Last week, I was on a panel about virtual work. Having first worked remotely in the 1980s, I wanted to share what helped me achieve the most.

1. Control yourself – maintain a work schedule and consistent habits, avoid personal distractions and tasks during work, seek an appropriate work/life balance

2. Control your environment – create a productive workspace, limit distractions from household members during calls/focused times (create a schedule of independent activities for children)

3. Stay connected – telepresence technology makes it easy to reach customers, colleagues and suppliers

4. Improve yourself – take control of improving what you do and how you do it

It is easy to grow unproductive if you are unmotivated and disconnected. Work hard when you are at work. Then, disconnect and enjoy your downtime and those you connect with, at home or virtually!

Leaders: inspire your teams to drive outcomes and measure what is delivered, not “inputs” like hours worked. I wish everyone success as they adjust to new work models.

Jeffrey Wu

SmartX: Smart Cities, Smart Energy, et al

Cooperation with Institute of Energy in Vietnam

Cooperation with Institute of Energy in Vietnam

At a meeting held at the Institute of Energy in Hanoi, Director General Tran Ky Phuc pledged to explore ways to cooperate on joint efforts with Actionable Strategies. Many topics including small nuclear reactors were discussed but the areas of greatest interest to the Institute of Energy are distributed energy resources, energy resilience, and cybersecurity.

It was agreed that the parties will continue discussions and meet again in person later in the year. We look forward to working with international colleagues to advance fit-for-purpose solutions to solve the most challenging problems in the energy sector.

MOU for Distributed Energy Resources and Battery Energy Storage in Vietnam

MOU for Distributed Energy Resources and Battery Energy Storage in Vietnam

Actionable Strategies has signed a Memorandum of Understanding to pursue projects in Vietnam around distributed energy resources with battery energy storage systems. The MOU with Rev1 Asia in Ho Chi Minh City will apply Actionable Strategies experience in strategy, project finance and modeling, technical analysis, implementation planning, environmental and developmental analysis, and regulatory review.

Combining sustainability with resilience is an ideal situation if the solution is financially feasible. We look forward to finding opportunities to help Vietnam responsibly increase energy supply to support economic growth.

National Power Transmission Corporation of Vietnam Industrial Revolution 4.0 Projects

National Power Transmission Corporation of Vietnam Industrial Revolution 4.0 Projects

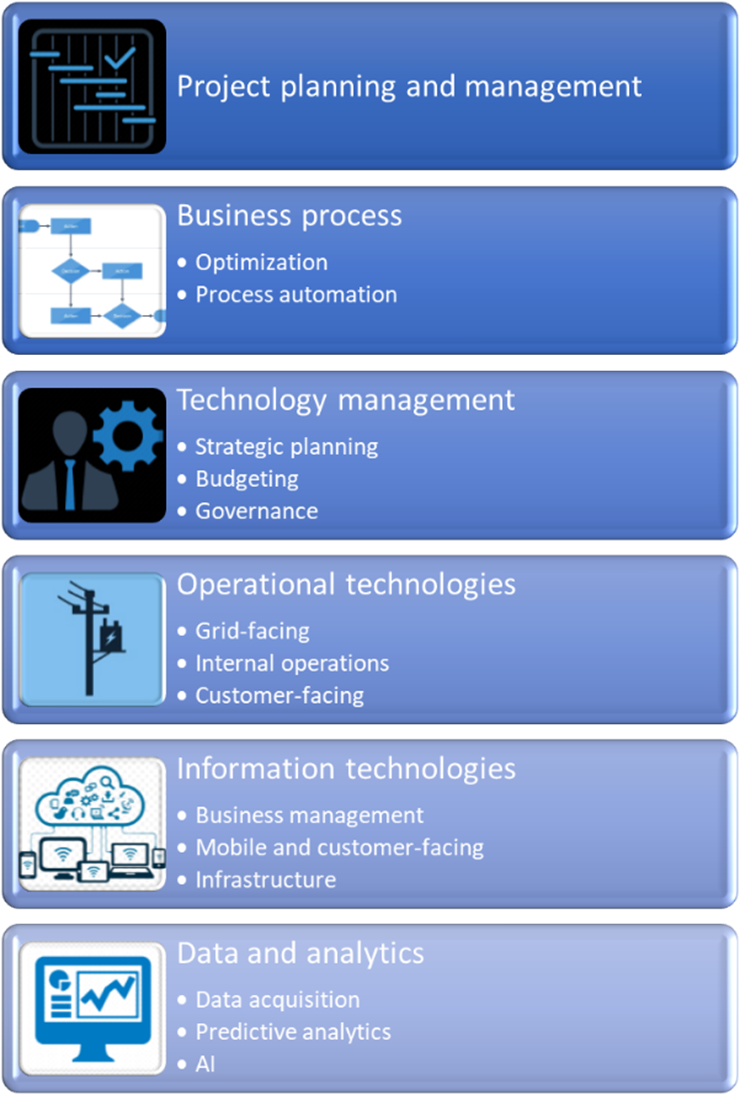

GVI, our partner in Vietnam, hosted a meeting and memorable dinner in their boardroom with their chairman (Mr. Dang Phan Tuong), CEO (Mr. Luong Lan Dung), and executive team. The Technical Vice President from the National Power Transmission Corporation of Vietnam (Mr. Luu Viet Tien) joined the dinner meeting. NPT is our first joint client and our cooperation has been a key element of success. The IT Roadmap 2.0 project will determine the Industrial Revolution 4.0 projects that will be built upon a new Enterprise Architecture.

Actionable Strategies always works with a local partner because of the importance of delivering targeted strategies and solutions specific to the country and region. We are thrilled to be pursuing opportunities in Smart Cities and ICT along with energy sector projects.

Smart Operations and Transportation in Turkey

Smart Operations and Transportation in Turkey

The Turkiye Smart Operations and Transportation Business Briefing in Washington DC illustrated a number of trends that Actionable Strategies has observed in other SmartX projects it has performed.

- Technology adoption

- Human capital

- Data and Governance

- Re-thinking boundaries

Technology Adoption

Technologies offer many potential benefits, but this potential can only be realized through adoption. This adoption often requires active management akin to marketing plans with sales campaigns and the attendant resources required.

Human Capital

Resources for these projects include CapEx and OpEx of which human capital is paramount. When I asked the delegates how they met their human capital needs it was surprising how broadly cities in Turkey look for talent. They fulfilled needs using offshore staffing, encouraging startups, hiring outside solution architects, and formalizing public-private partnerships.

Data and Governance

Equally critical is the flow of clean data. Embracing or even developing standards is essential. Turkey is unique in being both European and Asian with differing standards, privacy concerns, and governance approaches.

Re-thinking Boundaries

The nature of Smart initiatives is such that interconnection is inevitable. Smart Transportation or Operations should be considered an integral part of a Smart City planning and implementation. Consumers of services neither care about organizational boundaries nor do they want to experience seams across boundaries. Whether it is a flawless consumer experience, the flow of data, or the straight-through execution of process, a Smart City should deliver all of the above.

Fortunately, the delegates to this business briefing all adopted this approach with great success. We wish Istanbul, İzmir and Gaziantep ongoing success and hope to partner with their leadership to help drive their future.

MOU for Smart City In Vietnam Signed

MOU for Smart City In Vietnam Signed

Actionable Strategies signed a MOU for a Smart City project in the Central Coast region of Vietnam where the major National Highways 1A and 9 converge. In addition to developmental benefits, the initiative should reduce energy consumption, improve transportation infrastructure and therefore economic production, enhance public safety, stimulate human capital development, and reduce pollution. These benefits will be quantified as part of the project once we have produced a roadmap that addresses the broad set of stakeholders typical of Smart City initiatives.

The Smart City Roadmap will align to overarching strategic and technical goals of the Government of Vietnam and the regional People’s Committee. After Roadmap development, Actionable Strategies will develop a Business Blueprint to outline the capabilities, processes, and organization required to implement the roadmap. A Technical Blueprint will be provided to define the functional components, integration and enabling technologies, and infrastructure required for implementation.

Actionable Strategies will subsequently perform implementation planning. After generating risk managed project plans under a program umbrella, a financial model covering investment and operating cash flows will be built. Combined with the Roadmap and Blueprints, the model will be used to attract the required investments to implement the Smart City projects.

With ESG factors growing in importance, Actionable Strategies will also assess the environmental and social impacts of the Smart City initiative. We have found governance is a key issue for strategic, operating, and technology elements of Smart Cities which transcend traditional organizational silos. While the roadmaps will address the initial governance challenges, as the Smart City evolves new challenges will arise. Governance and other real-world implementation hurdles that are anticipated based on our other projects will be identified and placed into the context of this Smart City initiative.

The Memorandum of Understanding was signed in conjunction with the People’s Committee in Vietnam and our local partner in Hanoi. Actionable Strategies has found that successful outcomes and more rapid progress are achieved by combining global experience, consulting expertise, and local partnerships. We are grateful for the efforts our local partners have contributed to the success of our clients and our firm.

We are thrilled about this strategic Smart City endeavor that shows such great promise for large scale benefits.

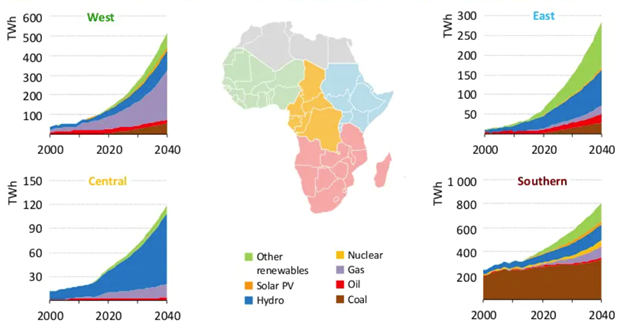

LOI for West African Energy Projects Signed

LOI for West African Energy Projects Signed

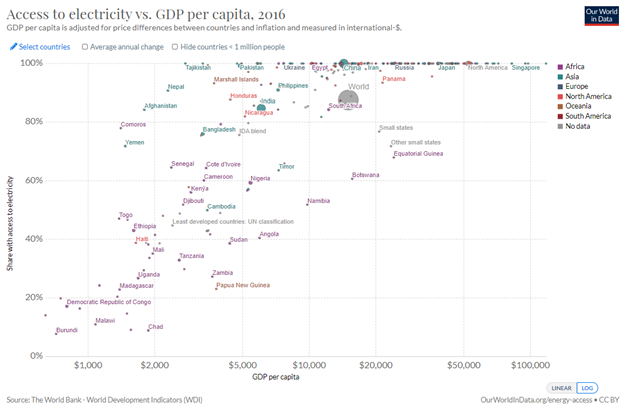

Actionable Strategies has signed a LOI to jointly develop energy opportunities in Western Africa. Sustainable development and resilience require a reliable and affordable supply of energy. Of the global population without access to energy, 75% of the people live in sub-Saharan Africa. That proportion has been increasing in recent years and the raw number of people without electricity in sub-Saharan Africa increased in 2020.

Africa poses unique challenges around infrastructure and financing but offers many clean energy options. We aim to apply our experience in energy and project finance to implement projects that support electrification in Western Africa and promote sustainable development. Our partner in Nigeria, Lavayo Energy, has successfully executed projects in the region and is run by a fellow Wharton alumnus.

While Western Africa has embraced natural gas as a cleaner alternative to coal, we are actively seeking cleaner generation sources including a combined hydro/solar plant. Balancing the need for affordable energy access with reducing environmental impact will be challenging. Financing will also be a challenge with many obstacles including political hurdles, credit worthiness, and operational risks. We look forward to attacking these challenges head on.

LOI for Vietnam Smart Cities Signed

LOI for Vietnam Smart Cities Signed

Actionable Strategies has signed a LOI to jointly develop Smart City and Smart Grid opportunities in Vietnam. Building on successful Smart City and Smart Grid projects in other emerging markets, we will adapt our strategies, architectural approaches, and implementation methods to the Vietnamese market.

Our local partner, GVI, will be instrumental in ensuring that we directly serve the unique needs of Vietnam. Their overlapping experience in Smart City and Smart Grid projects will allow us to operate with efficiency. Our past successes in Vietnam will directly benefit citizens, municipalities, utilities and companies participating in the continuing growth of the country.

We look forward to building on our past ESG work in Vietnam to ensure that economic growth is supported by sustainable and resilient practices. Responsible investment that supports growth and improves the life of ordinary citizens is a noble pursuit that we embrace with pride.

LOI for South Africa Solar Plant Signed

LOI for South Africa Solar Plant Signed

Actionable Strategies has signed a LOI for development of a 10MW solar plant in South Africa. This distributed energy solution will include battery energy storage to enable continuous operation. Recent changes in the political posture towards renewables has made smaller projects possible with fewer and less time-consuming regulatory barriers. If approved, this $70M project will meet key UN Sustainable Development Goals by building resilient infrastructure to provide clean and affordable energy.

Actionable Strategies will be initially responsible for the feasibility study which ensures that the solar plant can provide clean power generation that can flow back onto the grid. Technical analysis will model the reduction in outages, which avoids frequent loadshedding that occurs across South Africa. Independent power producers will be critical to meet the large gap in power supply that is constraining GDP growth.

The study will also evaluate the environmental and social impact of building the plant in a country that has been reliant on coal. The technical and environmental analyses are essential for international capital sources who will co-invest alongside the Industrial Development Corporation of South Africa, the majority investor. We will also develop the investment plan, lifecycle cost analysis and cash flow models under a number of scenarios.

The project still requires regulatory and initial funding approvals including a power purchase agreement and permitting for the plant. Our local partner stands ready to build and operate the plant once our planning and financing efforts have been completed. We are hopeful that the many benefits of this project will provide impetus for rapid approvals. As with most countries, many agencies and entities at various levels of the government are involved. Technology is not the constraint.

Actionable Strategies Placed on CT Preferred Energy Consultants List

Seven consultants from Actionable Strategies have been placed on the list of preferred consultants for Connecticut’s Department of Energy and Environmental Protection. If called upon, we will address issues affecting the cost and provision of energy, telecom, water and utility services. This may include the development of a Comprehensive Energy Strategy, Integrated Resources Plan, Conservation and Load Management Plan, Weatherization Assistance Program, energy procurements, and microgrid and resilience programs. We may also assist with regional and national issues related to energy markets, electric and natural gas transmission systems, and environmental and siting issues related to energy.

Seven consultants from Actionable Strategies have been placed on the list of preferred consultants for Connecticut’s Department of Energy and Environmental Protection. If called upon, we will address issues affecting the cost and provision of energy, telecom, water and utility services. This may include the development of a Comprehensive Energy Strategy, Integrated Resources Plan, Conservation and Load Management Plan, Weatherization Assistance Program, energy procurements, and microgrid and resilience programs. We may also assist with regional and national issues related to energy markets, electric and natural gas transmission systems, and environmental and siting issues related to energy.

Actionable Strategies proposed qualified consultants with success in energy, environmental, telecom, and utility regulatory sectors. As such, we may consult in regulatory matters with FTC, DOE, NRC, SEC, FTC, FCC in energy planning and utility regulation, and encompassing the gas, water, telecommunications, and electric utility disciplines.

Matters include finance, engineering, economics, rate design, grid or network modernization, system planning and needs assessments, renewable energy, renewable portfolio standards, energy storage, market forecasting and analysis, electric transmission and distribution planning and analysis, cybersecurity, mergers and acquisitions, retail energy supply, decarbonization of the transportation and building sectors, energy and telecom infrastructure, and environmental issues.

We look forward to helping build a sustainable future for Connecticut.

Future of Renewables and Emerging Markets

At the Future of Renewables Global Event, a World Bank speaker illustrated the positive impact of Actionable Strategies’ energy projects in emerging markets.

At the Future of Renewables Global Event, a World Bank speaker illustrated the positive impact of Actionable Strategies’ energy projects in emerging markets.

Developed countries take for granted that we will quickly gain access to COVID-19 vaccines once they are available. However, approximately 1 in 8 people in the world lack electricity. This means that the cold chain to supply vaccines will be very difficult or nearly impossible to maintain in some parts of the world.

One of our current projects seeks to promote electrification which has a positive impact on public health and education. Almost 40% of the world cannot use clean cooking sources and two-thirds of these people burn animal waste for fuel. This household air pollution results in 4.3 million deaths annually which is more than HIV/AIDS, malaria, and tuberculosis combined.

Environmental and social objectives overlap when it comes to electrification. Educational benefits ensue as power enables children to read by electric lighting instead of candles. Any digital divide cannot be closed without the ability to power devices and networks.

Actionable Strategies is fortunate to be able to work at the juncture of strategy, sustainability, social responsibility, and technology.

Smart Grid Strategic Objectives for Myanmar

As an emerging market poised for growth, Myanmar will benefit as it builds out Smart Grids as part of its critical national infrastructure. Grid unreliability, outages, power shortages and an extremely low electrification rate have prevented Myanmar from realizing its potential while other ASEAN nations have enjoyed great success. In addition to direct improvements for citizens and businesses, Myanmar will realize a range of benefits from economic, environmental and developmental. Our work in other emerging markets has demonstrated these benefits and prove they apply to regions around the globe.

Economic Benefits

Economic growth and prosperity are directly linked with electricity consumption. Myanmar has the lowest electrification rate in South East Asia. With only 50 percent of households connected to the public grid, this is a major constraint to the economy especially when combined with the power quality issues that impact businesses across the country. Greater electrification will drive logarithmic increases in output as experienced in other emerging markets.

- Per capita GDP increases with final energy consumption which is currently impacted by loss of electrical service

- Grid modernization will increase investor confidence and attract greater FDI flow into Yangon

- Grid modernization will improve access to electricity and yield direct economic benefits through poverty reduction

- Rural development will accelerate with electrification

- Modern technologies such as mobile communications can accelerate economic development but are dependent upon reliable and ubiquitous power

Social Benefits

Universal access to electricity will dramatically impact education. Education has direct social benefits and also translates to economic benefits. Access to proper lighting is critical to enable students in primary and secondary education. Digital access will continue to play a more important part of education at all levels which is not possible without reliable access to power.

Universal access to electricity will dramatically impact education. Education has direct social benefits and also translates to economic benefits. Access to proper lighting is critical to enable students in primary and secondary education. Digital access will continue to play a more important part of education at all levels which is not possible without reliable access to power.

Environmental Benefits

Environmental benefits range from incorporation of clean generation to reducing environmental impact at the point of consumption.

Environmental benefits range from incorporation of clean generation to reducing environmental impact at the point of consumption.

- Greenhouse Gas reduction will occur by reducing distribution system losses which are currently 15%

- Clean and Renewable Energy sources can be integrated into the grid once modernized

- Pollution will be reduced by reducing system losses as generation requirements are reduced

- Pollution will be eliminated when electrification replacing dirty cooking which 79% of the country uses and dirty lighting sources

Citizen/Customer Benefits

The citizens and businesses of Yangon are not frustrated with the current state of the Grid and dissatisfaction is universal. Outages, power cuts, safety, service times and installation costs are all major issues.

- Grid Reliability is the major issue impacting business and citizens who lack a basic level of safe and reliable service

- Safety is a significant concern with injuries and deaths occurring due to grid-related accidents

In the future, a Smart Grid will enable utilities to proactively drive other areas of customer satisfaction.

- Proactive communication about power outages and restoration improves customer satisfaction

- Maintaining the grid dramatically increases business satisfaction, especially for businesses

- Environmental responsibility is appealing to customers

Critical Infrastructure Benefits

The power grid is part of any modern country’s critical infrastructure. Grid modernization ensures businesses and citizens have the greatest opportunities and quality of life.

The power grid is part of any modern country’s critical infrastructure. Grid modernization ensures businesses and citizens have the greatest opportunities and quality of life.

- Universal Energy Access by 2030 will be supported which is stipulated in the country’s National Electrification Plan (NEP)

- Power Quality will improve for mission critical use cases such as hospitals and businesses that require uninterrupted power

- Resilient Infrastructure including Distributed Energy Resources and Microgrids will be supported which is also a NEP goal

- Power Losses and Power Shortages will be reduced which is a major issue for the country

Human Capacity Building

Myanmar will build human capital skills and capabilities learned while working with Smart Grid technologies.

Myanmar will build human capital skills and capabilities learned while working with Smart Grid technologies.

Leaders and workers will accumulate knowledge, experience, and proven approaches

These skill sets are in demand globally with project management and IT skills applicable across industries

Financial Markets

Nigeria’s eNaira Potential

Nigeria’s eNaira Potential

In this article in Leadership News Update in Nigeria, Actionable Strategies’ CEO Jeffrey Wu was quoted about the potential for Nigeria’s eNaira digital currency. While the ability to leapfrog directly into the digital realm is game changing, he stressed that this is not the goal but the means to an end.

The objectives of digital currency adoption in Africa are broader financial inclusion, lower transaction costs, facilitating economic growth especially in the currently informal economy, and enabling organic innovation.

eNaira: Experts Suggest Ways To Increase Digital Currency Penetration

Written by Mark Itsibor

Experts in the digital currency space have agreed on ways to deepen acceptability of digital currency in Nigeria, especially the Central Bank of Nigeria owned eNaira. They were unanimous on that fact that inclusion of the unbanked into the financial sector is made possible by providing technologies as long as the appropriate operational models and regulatory frameworks are implemented.

Experts in the digital currency space have agreed on ways to deepen acceptability of digital currency in Nigeria, especially the Central Bank of Nigeria owned eNaira. They were unanimous on that fact that inclusion of the unbanked into the financial sector is made possible by providing technologies as long as the appropriate operational models and regulatory frameworks are implemented.

Founder, Blockchain Centre and CEO of Bitcoin Sam Lee said the progress of eNaira can be enhanced by stable coin regulation to create healthy competition to the existing government-backed eNaira system.

Lee said to increase digital currency penetration into the market would mean that there has to be a stable coin framework so that the market can create competing systems to the eNaira. “Competition is great if it’s from the private sector,” he said, “but under regulatory regime.”

He is also the chairman of blockchain lab under the China Academy of Science, which is the largest research institute in the world. It drives the adoption of digital currencies in the Chinese domestic market.

Speaking at a pre-conference virtual meeting with the theme: “Building a Cashless Syatem: Understanding the Digital Currency, Lesson from eNaira,” the experts say Nigeria and indeed Africa need to urgently create cashless economy that is driven by technology.

Rakiya Mohammed who oversees the information technology department of the CBN disclosed that there 36 million people in the financial sector in Nigeria. She said the engagement will help to deepen the goal of the eNaira.

Mohammed highlighted the many security steps already taken to ensure that the process is not manipulated but secured end-to-end.

She said “if we are able to get most of the informal sector into the financial sector, we would be able to measure our GDP based on their contribution.”

Chairman & president of Future Trends Group Farzam Kamalabadi said there is future possibility of loops of currencies converging with each loop being added to the value, “this is what we plan to build in Africa.”

He said the future trends of cashless payment is when new emerging economies have the chance to bypass what classic economies are doing.

Kamalabadi said the benchmark is to create economy in Nigeria that is $1 trillion as soon as possible. “Nigeria is close to that; it only needs a triple economy. 20 other African nation’s need to have within seven years, a $1 trillion economy plus a $1 trillion sovereign wealth fund; same size as Abu Dhabi Investment Authority. Each of the African countries already have the wealth but it is not actualized,” he stated.

Global advisor of Global Chamber & the CEO of ONS Triumphs Ltd Ogbonna Ukuku said here should be a more creative way of getting funding to support fintech in Africa. There must be a profit in that transaction. He said investors have a particular attitude who invest only in where they can make their money back.

On his part, CEO of Actionable Strategy Jeffrey Wu said Africa can leapfrog western payment systems by skipping bank and credit card accounts and moving directly to digital-only accounts using mobile/Web first platforms.

“A durable and scalable approach requires operational discipline, pragmatic regulations, prudent risk management, and realistic expectations. This extends to all stakeholders: individuals, merchants, larger vendors, and governments (as payors, payees, and regulators). In addition to utility and cost, adoption also requires trust. Knock-on benefits from innovation can then be realized,” he said.

Digital Currencies in Africa

Digital Currencies in Africa

When Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN), received an award from the Foreign Investors Network in the fall, the eNaira had just turned a year old. As the first fiat digital currency in Africa and the second in the world, the eNaira was groundbreaking. (Also pictured is the impressive Vera Esperança dos Santos Daves De Sousa, Angola’s Minister of Finance.)

In a roundtable discussion about Cashless Africa yesterday, the lessons learned from eNaira proved insightful. Rakiya Muhammed, head of IT and CISO at the CBN stated some well anticipated benefits such as digital inclusion of the 26 million unbanked Nigerians. She also noted better visibility into the true GDP of the country, which also enables the potential taxation of transactions previously invisible to the government.

Consumer adoption was bolstered by confidence in the safety of the eNaira. Backing by the CBN and Government of Nigeria were essential. There was no major panic after the collapse of FTX.

Madame Rakiya also cited secondary benefits from FinTech innovation and investment opportunities spurred by confidence in blockchain technology. An example was Boom which is a costless platform for payments, money transfers, and transactions. Inside the government, benefits payments are being moved to digital wallets benefitting all stakeholders.

eNaira adoption was unsurprisingly not as ubiquitous as hoped, so I asked Rakiya to name the key lessons and constraints. I was especially concerned with merchants who are often ignored when talking about using cryptocurrencies for transactions. Her observations: Individuals were able to onboard without a smartphone using a verified phone number and bank account. Merchants had the same requirement but also required an active Tax ID Number (TIN). Adoption was hampered because many small merchants either had no TIN or it wasn’t active. Issues with bank verification also impacted small merchants who are part of a very large informal economy.

Regulation was a priority topic with roundtable participants concerned that reasonable frameworks be applied to protect users in different markets. It was noted that the pace and regulatory overhead varied by market which has led to jurisdiction shopping/regulatory arbitrage. The CBN applied KYC and AML practices as well as limits on transaction sizes. It is evaluating looser restrictions for very small merchants to broaden digital inclusion of the informal economy.

Leapfrog opportunities using technology to bypass traditional models is exciting. However, operational discipline, pragmatic regulations, prudent risk management, and realistic expectations are still essential elements of success. Technology by itself is not a solution and there needs to be real uses cases for emerging technologies.

Cashless Africa

Cashless Africa

Actionable Strategies’ CEO Jeffrey Wu was asked to address Cashless Africa in Abuja, Nigeria on the opportunities to advance economic inclusion, close the digital divide, and accelerate economic development by leapfrogging traditional finance into the digital realm. The cashless model is not the goal, but a means to these ends.

Presenters at the conference included:

Professor Isa Pantami, Minister of Communications & Digital Economy of Nigeria

Senator Pat Meyer, Founder & President of the UN Alliance for Sustainable Development Goals

Brigadier General Dr. Ambassador Wallace Williams, Consul General of Antigua and Barbuda / Africa Representative of Global Bank Antigua

Acknowledging the potential, I also stated prerequisites for success. Technologies such as digital wallets and cryptocurrencies work in specific use cases but require an organizational foundation. This includes a viable operating model, critical mass of adoption, scalability, and trust.

Example: traditional bank accounts provide security to store money, utility to withdraw money and make payments, broad acceptance, and trust. These same characteristics must form the foundation for digital applications.

Providing these fundamental capabilities to the 57% of Sub-Saharan Africans that are unbanked would be monumental. One major reason this is not a reality: digital inclusion cannot occur without Internet access which lags badly on the continent at around 40%. Progress is encouraging but gradual ramp-up must be considered when estimating the total addressable market.

App development also faces impediments which slows innovation. Many users access the Web from Internet cafés or feature phones (which have a Web browser but do not support the installation of app). Platform providers must design and develop to the lowest common denominator.

There are working technologies, such as the eNaira and M-Pesa, which have achieved critical mass. They have a viable operating model and proactively drove adoption.

African business leaders I speak with are frustrated with the lack of capital to build their businesses. Investment will only flow to those opportunities that are viable and scalable. “Build it and they will come” worked only in the movie Field of Dreams. Adoption, efficient operations, trust, scalability and viable use cases are required in the real world, regardless of the market.

Misstating the opportunity by citing population statistics instead of a more realistic serviceable obtainable market estimate that ramps up over time will discourage investment. Likewise, planning to build an organization that drives uptake and scales up makes funding more forthcoming.

In execution, adoption needs to be proactively driven across all stakeholders. This extends beyond consumers to include merchants big and small, as well as (central, provincial, and local) government entities who act as both payors and payees. Small merchants are essential on the continent due to the very large role played by the informal economy which accounts for over 80% of jobs.

These cautionary comments were provided to help enable solid planning and attractive foreign investment. I remain hopeful that Africa can achieve its potential and that I can play a small part in helping.

Banking on Emerging Markets

Banking on Emerging Markets

Actionable Strategies’ CEO Jeffrey Wu led a panel on emerging markets finance. The panel included Godwin Emefiele, Governor of the Central Bank of Nigeria; Vera Esperança dos Santos Daves De Sousa, Minister of Finance of Angolal; and Ken Ofori-Atta, Finance Minister of Ghana.

Like other emerging markets, African countries have the opportunity to leapfrog from struggling EM economies to rapidly creating a prominent middle class in a single generation. Investing in promising opportunities can create a trajectory of market maturity creating domestic demand that powers economic growth. Foreign direct investment should apply the many lessons learned from other emerging markets.

Human capital development is essential to ongoing success. Using foreign expertise is necessary to jump start initiatives, but local talent should learn from these early projects and strive for self-sufficiency. As practical knowledge is spread more broadly in the workforce, capabilities will catch up with demand and local competition will provide alternatives to foreign brands. Upskilling the workforce will also increase purchasing power yielding a multiplier effect for economic development.

Basic business infrastructure cannot be taken for granted. Power, internet connectivity, transportation, and real estate are often constraints and require investment to enable businesses to start up and grow. Fortunately, there are opportunities to leapfrog developed markets by making smaller incremental investments where infrastructure does not exist. Examples include microgrids instead of building power plants and transmission lines, and wireless connectivity instead of laying cables and wiring buildings.

Governance plays an even greater role in emerging markets. Corruption is everywhere but has less impact in developed and frontier markets. Friction from bureaucracy and regulation can make market entry unattractive or non-viable. Lack of harmonization across individual markets can limit or prevent cross-border business growth.

Emerging markets face other significant challenges in both the private and public sectors. However, the long-term potential should not be overlooked. Outsized returns in previous emerging markets should demonstrate the possibilities and prerequisites for success.

Gamestop Speculation and Market Structure

Gamestop Speculation and Market Structure

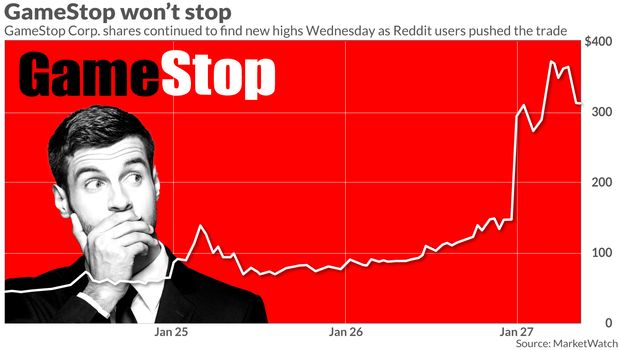

Trading in Gamestop highlighted weaknesses impacting market participants. Grandstanding politicians from all sides appear misinformed (e.g., confusing gamification with gaming the system). The issues are more complex than mere headlines.

Robinhood suspended trading because they lacked liquidity required by regulation, forcing them to raise over $1B. They were NOT protecting hedge funds or individual investors.

Speculation differs from investment. Trading highly shorted stocks via margin and options with inflated IVs is risky and unsuitable for most individuals.

Lack of understanding about trading abounds. Brokers are not obligated to execute orders. Margin is an interest-bearing loan. Different trading platforms can provide better execution if they do not sell order flow.

Individuals have the right to speculate but there is personal responsibility. Hedge funds with concentrated positions or excessive leverage felt this pain.

Regulators need to refine rules such as short interest exceeding float and circuit breakers. Rumors and trading ideas on social media are not market manipulation under SEC regulations. Notably, crowds fueled by social media can and do move markets, a fact that cannot be ignored. FINRA’s suitability standards must still be applied.

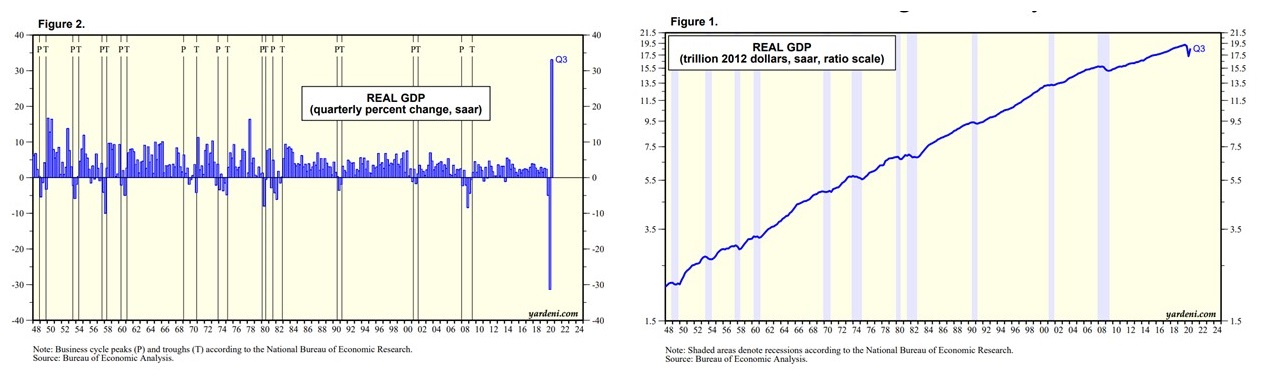

Economic Recovery Underway

Despite economic hardship still impacting many, it appears the start of the recovery is well underway. While there are risks, history suggests that the recovery should become robust. The generally bullish Ed Yardeni spoke about factors affecting the recovery. Charts on his Website make it apparent that the pandemic hit our economy more deeply and quickly than other recessions, but GDP is already rebounding.

Recovery will be uneven and potentially unfair to some, but that necessitates thought and action to participate fully in the re-expansion of the economy. Some strategies and operating models may no longer be viable with their downfall accelerated by the almost immediate shift in workplaces and homebound consumers. Different skills and abilities will be required creating disruption as well as opportunity for workers.

For organizations, leaders and individual contributors, the real post-vaccine new normal is upon us in developed markets. Stock market corrections (10% drops) will still occur but taking a longer term view allows us to see the recovery in progress.

Environmental, Social, and Governance

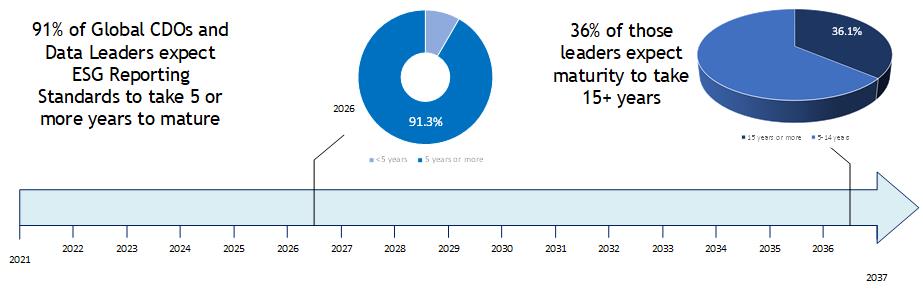

Distant Horizon for Maturity of ESG Reporting

At the CDO and Data Leaders Global Summit, ESG reporting practitioners affirmed our assertion that there are too many standards with continued uncertainty anticipated. Significant changes in reporting requirements obviates a simple solution, whether vendor led or homegrown. We advise organizations to treat ESG reporting as any other data analytics initiative with unclear and emerging stakeholder needs.

Jeffrey noted that transformation has always been predicated on successful business implementation: “This was equally true when I spoke extensively about eBusiness in the early 2000s and the wins clients experienced. Technology was less mature but similarly a pure enabler to strategic plans that impacted all facets of a business from customer-facing models to internal operations.

Cost takeout and process automation are noble tactical goals, but organizations should not expect true transformation from implementing RPA and other technology that delivers incremental gains. Likewise, transformation will inevitably reduce costs as legacy processes are improved and automated.

IT tools are robust, but they don’t transform; they enable the very difficult work of rethinking and reorienting a business. Placing the customer first, defining vital outcomes and aligning internal metrics all enable the focused application of technology.”

ESG and Transformation

ESG and Transformation

Reflecting on Earth Day, it is notable that ESG issues have become prominent after years of inconsequence. At a global conference, the UN Development Program’s Achim Steiner said “vision, optimism and direction and not despair” will lead to advances. However, these advances will be limited since transformative change cannot yet reverse the damage done.

“Economies provide information and tools but are not wiser than any individual.” Mr. Steiner stated that our choices are as important as economics and technology. While personal responsibility is absolutely essential, we are convinced that market and structural issues must be addressed.

Global financial resources for ESG initiatives exist but inertia keeps focus on 20th century economics, according to Mr. Steiner. Forward-thinking investors recognize pollution, loss of natural resources, and environmental damage all impact the economy. Many have embraced the UN’s SDGs. Actionable Strategies has applied the SDGs in our work in recent years with very positive acceptance from clients.

Capital flow is important to enable environmentally focused projects and socially responsible investments. However, we also strongly advocate for better policy and planning. There are numerous large-scale changes that must be planned and managed by many stakeholders in both the public and private sectors.

- Energy generation will require fossil fuels for many years which necessitates better practices during the transition of the generation mix.

- EVs, renewables and distributed generation pressure the power transmission and distribution grid infrastructures which means that attention must be paid to this overlooked and highly regulated sector.

- Lifecycle impact must be examined because in reality there are never very simple solutions to highly complex problems. For example, batteries require environmentally destructive mining which often uses exploited workers. Recycling of batteries is not currently efficient and proper disposal practices are far from universal.

- Excessive bureaucracy impedes innovation and implementation in the energy and other sectors.

Mr. Steiner said the private sector, dominated by small to mid-sized companies, must be involved. Good policy advocates understand the reality of markets in the majority of countries. The world needs more intelligent and comprehensive policies and less political rhetoric.

Employees and ESG Reporting

Employees and ESG Reporting

At a Penn Club discussion of her book, Judy Samuelson of the Aspen Institute postulated that businesses themselves are an amoral operating structure and that people determine the morality of behavior.

With 80 percent of a company’s value being intangible, she stated that employees have great influence as allies and are not just a cost. Contributing factors include transparency from social media, physical plant and financial capital declining in importance vis-à-vis human capital, supply chain complexity and environmental considerations.

Highlighting the difficulties with ESG measurement given the numerous and often conflicting “standards”, we asked Judy how she thought management of ESG concerns would evolve. She replied that organizations cannot possibly expect to measure environmental or social progress in simplistic measurements. Judy sees companies being pressured and stepping up to commitments like net zero carbon.

We have written about managing reputation as an asset, establishing an aspirational ESG strategy and executing for the benefit of all stakeholders. This posture to ESG is becoming increasingly more mainstream.

ESG Investment and Product Opportunities

ESG Investment and Product Opportunities

Despite gaming and greenwashing, ESG is a significant, visible private sector concern. World Bank President David Malpass urged private lenders to be socially responsible and support debt restructuring. Poor countries pay 6-7% interest, crowding out spending on COVID-19 vaccinations. WB lending opens emerging markets for private investment so they have gravitas.

At the same conference, National Economic Council Director Brian Deese emphasized the need for private sector participation in President Biden’s environmental objectives. He identified benefits including growing exports for EVs and other technologies. The belief is that by “unleashing private capital” the US can “create products that consumers will choose to purchase”. Acknowledging that the government cannot succeed alone, Deese stated that “private capital is required to accelerate the transitions to zero emissions”.

While there is downside to ignoring ESG concerns, there are concrete opportunities that continue to emerge. We are enthusiastic at the prospect of doing good while doing well. Leaders from both ends of the political spectrum are actively engaged. Our experience with public-private partnerships in Smart Grid and Smart City initiatives is convincing evidence that the model works.

ESG Pushback and Controlling Reporting

“ESG is nonsense!”, according to some investors. At a recent investment conference, a number of institutional asset managers pointed out the fallacies surrounding ESG. They cited greenwashing of fundamentally destructive environmental practices, the lack of clear definition of ESG and use of the ESG moniker for pure marketing purposes. While they are correct, this does not belie the fact that environmental, social and governance issues will receive increasing focus.

“ESG is nonsense!”, according to some investors. At a recent investment conference, a number of institutional asset managers pointed out the fallacies surrounding ESG. They cited greenwashing of fundamentally destructive environmental practices, the lack of clear definition of ESG and use of the ESG moniker for pure marketing purposes. While they are correct, this does not belie the fact that environmental, social and governance issues will receive increasing focus.

“You can’t put the smoke back in the stack” and other metaphors describe the fact that many investors, business leaders and most importantly customers consider ESG practices important for organizations. While companies should adhere to their (hopefully) virtuous principles, they must also ensure that stakeholders understand the true strides they are making. Actively controlling the flow of messaging, statistics and third-party reporting will be critical to ensuring that organizations are viewed in the proper light without duplicity.

Actionable Strategies has performed analysis of ESG reporting for a number of publicly traded companies. Our findings for these organizations are consistent with a longitudinal study by MIT that included 641 indicators. One major conclusion that “a significant portion of the measurement divergence is rater-specific and not category specific, suggesting the presence of a Rater Effect.” This is a clear indication that companies need to both control the qualitative aspects of ESG reporting as well as quantitative reporting of metrics in categories relevant to the rating agencies.

Because of the large number of ESG Reporting frameworks and the lack of standards, companies cannot simply report using one framework in a Website post. Our approach is to gather all information relevant to ESG stakeholders into a repository such as a data warehouse. Stakeholders are very broad and some are not part of traditional value chains. Information can also include unstructured data especially with social media being an important publishing medium.

Mapping the data to multiple frameworks then allows the organization to control the ESG Reporting “message”. This increases the likelihood that rating agencies will appropriately assess the positive actions of the company. It also decreases the chance that negative ratings are inappropriate assigned. It isn’t greenwashing if it is true, consistent and contextually accurate.

Reputational Risk and Market Value

Reputational Risk and Market Value

A company’s reputation is a precious intangible asset that is directly affected by ESG activity. Investors, customers and employees are growing more aware and concerned with environmental, social and governance considerations. ESG actions can enhance or diminish the reputation of a company.

Organizations should extend reputational risk management to encompass reputational asset management. A 2012 World Economic Forum study attributed 25% of a company’s market value to reputation. By 2019, a survey of global executives attributed reputation to 63% of market value. Financial stakeholders are paying attention to ESG risks and economic value.

Neil Roberts discussed “A Sustainable Future” at the Reuters NEXT conference and the topic is top of the executive agenda. Aon’s 2019 Global Risk Management Survey identified Damage to Reputation / Brand as the #2 risk to businesses. The only higher risk was economic slowdown / slow recovery.

Leaders face personal risks as well. A Harvard Business Review study found that executives from scandal tainted firms earned 6% less on average. In financial services, executives from companies with scandals were paid 10% less than peers.

We are applying asset management approaches to ESG processes and analytics but this concept is admittedly in the nascent stages. As leaders continue to embrace ESG, whether driven by principles or self-interest, proactive and strategic management of ESG will develop as part of managing the overall value of companies.

Aligning ESG to Strategy

Ensuring strategy aligns to ESG goals is a growing part of our work. In Myanmar, we are involved in a power infrastructure project which will reduce existing emissions and integrate renewable energy sources. This aligns directly to country-wide commitments made by Aung San Suu Kyi, Myanmar’s State Counsellor, at the recent UN Climate Ambition Summit.

Among other targets, Myanmar aims to reduce over 243 million tons of CO2 by increasing the share of renewable energy to 39%. The UN Secretary-General and 75 Heads of State and other high-level officials also delivered video statements at the Summit. They made new commitments to tackle climate change and deliver on the Paris Agreement.