Transformation and Optimization Capabilities

Our transformation and optimization activities focus on radical improvement of major business functions.

- Sales and Marketing, such as adding digital touchpoints

- Operations, typically gaining leverage from automation technologies

- IT, moving from a utility to a solutions provider

- Product development, accelerating time to market

In an interview, Actionable Strategies’ CEO Jeffrey Wu discussed Digital Transformation as changing the business itself. This may encompass delivering new products or services, reaching new markets, and reaching customers from sales to service.

Transformation involves improving business processes that support the value chain from producing products and services to providing customer service.

Technology is an enabler and not the target of transformation itself. To be successful, technology must take advantage of the data assets of an organization.

The client is a global bank and one of the ten largest in the world. Onboarding clients is a key process but presents significant challenges. The Change Management executive stated that he “needs what Actionable Strategies does” after an internal referral from the business. Actionable Strategies met both the stated needs of the client as well as a plethora of unplanned requirements.

The client is a global bank and one of the ten largest in the world. Onboarding clients is a key process but presents significant challenges. The Change Management executive stated that he “needs what Actionable Strategies does” after an internal referral from the business. Actionable Strategies met both the stated needs of the client as well as a plethora of unplanned requirements.

Client Profile

The client is a global bank and one of the ten largest in the world. Formed over 150 years ago, it operates nearly 4,000 offices in 67 countries. The bank has over 40 million customers.

Business Challenge

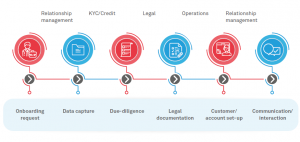

Onboarding clients is a key process but presents significant challenges. While the basic process is easily understood, the intricate details and permutations experienced by a large financial institution introduces significant complexity.

The client was establishing a global Center of Excellence headquartered in New York to ensure that onboarding was efficient, timely and met the myriad compliance regimes required around the world.

The client was establishing a global Center of Excellence headquartered in New York to ensure that onboarding was efficient, timely and met the myriad compliance regimes required around the world.

A Change Management program was established to ensure that the rollout successfully addressed all aspects of implementation.

- Process

- Technology

- Compliance

The Change Management executive stated that he “needs what Actionable Strategies does” after an internal referral from the business.

Transformation Services

In addition to bringing expertise in process, technology and banking compliance, Actionable Strategies met other needs expressed by the client:

- Client interaction including executive and front-line presentations, and leading workshops

- Financial analysis and budgeting

- Project management including project and program planning

Actionable Strategies engaged with numerous stakeholders across the bank. These stakeholders operated at all levels of the organization.

Examples of specific interactions with diverse functions include the following:

- Budget management including cost tracking reporting to the CFO in London

- Consulting in Transformation including Analytics Development and Presentation

- Change Management workshop delivery

- PMO integration

- Process development including reconciliation across sub-processes

- Business requirements specifications for asset management

Actionable Strategies met both the stated needs of the client as well as unplanned requirements. Based on the knowledge, experience and specific results delivered, the client made several referrals within the bank and to peer institutions.

This global bank engages in a range of activities including safeguarding assets, lending money, making payments and accessing the capital markets on behalf of clients. The bank sought to improve performance and rationalize costs on a worldwide basis. Global Technology and Operation believed operations and maintenance spending was crowding out new investments in both technology and other areas.

This global bank engages in a range of activities including safeguarding assets, lending money, making payments and accessing the capital markets on behalf of clients. The bank sought to improve performance and rationalize costs on a worldwide basis. Global Technology and Operation believed operations and maintenance spending was crowding out new investments in both technology and other areas.

Actionable Strategies was engaged to tie together the strategic program delivering a target state operating model, transition processed, program plan, and metrics to measure progress and subsequently sustain improvements and cost savings.

The optimization initiative was an all-around success, but unheralded because it was not disruptive. Program planning and iterative executions de-risked the initiative and delivered early, quantifiable results. Initial optimization delivered $27.6 million in savings with improved service delivery. Funding was freed up for innovation and change-the-bank initiatives. Additional optimization produced recurring savings exceeding $15 million annually.

Client Profile

This global bank engages in a range of activities including safeguarding assets, lending money, making payments and accessing the capital markets on behalf of clients. The institution is 200 years old and has connected millions of people across hundreds of countries and cities.

Business Objective

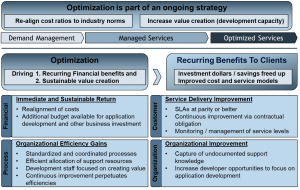

The bank sought to improve performance and rationalize costs on a worldwide basis. As a global financial institution, technology investments are essential. As time passes, ongoing operations and maintenance spending can become an overwhelming portion of budget and crowd out new investments in both technology and other areas. Naturally, one of the largest budget areas that required scrutiny was the Global Technology and Operations organization.

The bank sought to improve performance and rationalize costs on a worldwide basis. As a global financial institution, technology investments are essential. As time passes, ongoing operations and maintenance spending can become an overwhelming portion of budget and crowd out new investments in both technology and other areas. Naturally, one of the largest budget areas that required scrutiny was the Global Technology and Operations organization.

Given the size and scope of the organization, assessing the opportunities for optimization were quite complex. Cost takeout was a consideration, but analyses needed to be conducted around the employee effects, internal customer impact, risks and change management. The executive in charge of the program engaged Actionable Strategies to help him tie together the many activities and convey it as a strategic program to executive leadership.

Project Overview

Optimization focused on ongoing “run-the-bank” activities related to technology such as infrastructure engineering and application maintenance and support. The target was to free up half of the RTB budget to fund additional investments in innovation and new applications.

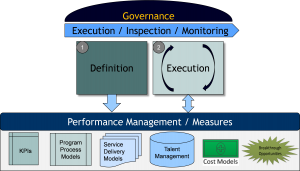

The project had two distinct phases:

- Definition

- Assess resource models

- Transition process design and division of responsibilities

- Program plan and milestones

- Metrics development for transition and steady state operation

- Execution

- Milestone reporting to executives on progress and savings

- Monitor transition as each tranche is optimized

- Ongoing inspection of service delivery quality and cost.

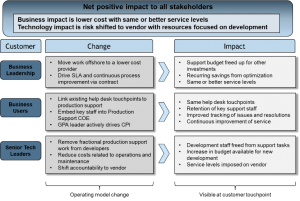

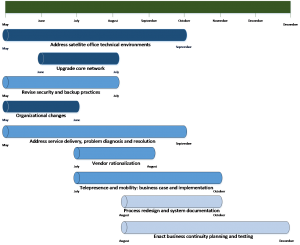

The engagement structure appears below.

Definition Phase

Definition provided three outcomes for the client.

- Validation: Ensure that the target state operating model is achievable considering many factors including:

- Reported time allocation

- Estimated future resource requirements

- Internal customer request flow and backlog

- Work absorbed in other areas that must be reclaimed

- Changes in overhead and coordination efforts

- Vendor models of effort

- Prove-out: Accurate calculation of an achievable ROI factoring in estimation variance and unplanned P&L impacts

- Planning: Detailed planning to enable the client to execute on transition with particular focus on definition of:

- Transition process included steps for all roles involved

- Human capital model included changes in responsibilities or organizational structure

- Milestone definition

- Metrics for reporting and ongoing monitoring

This target state operating model was critical to successful execution. The optimized operating model was expected to last for many years. Benefits would be recurring and anticipated to be large, enabling innovation and change-the-bank activities without new investments.

Execution Phase

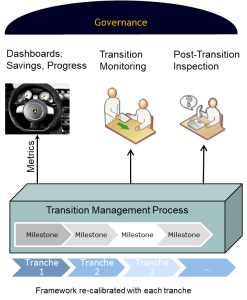

Execution involved the transformation of individual functions grouped into tranches. These tranches were managed and monitored separately using a structured process defined in the definition phase.

Because of this structured process, execution went exceptionally smoothly.

Because of this structured process, execution went exceptionally smoothly.

- Milestone reviews flowed metrics into dashboards enabling the client to:

- Track savings

- Demonstrate progress

- Monitor transition activities within each tranche

- Inspect and verify of reported results

- Post-transition, inspect ongoing activities

- Confirm and ensure savings

- Report on additional breakthrough opportunities

Key Takeaways

While broad in scope, this initiative had similarities to other complex projects with diverse stakeholders.

Program Management

The PMO expended significant effort managing vendors and individual projects, necessitating the use of Actionable Strategies at a strategic level to link program activities and results to senior executives.

Operating model

The target state operating model was critical to success as with any transformational project. The key in this case was the focus on ensuring Service Delivery did not decline and that optimize would yield improvements.

Change Management

Transition planning combined with effective communication simplified the significant change in underlying operations. Planning to minimize disruption for internal customers enabled better results.

Effective Metrics

Implementing a measurement model focused on results facilitated effective management during transition and steady state operations. Managing transition by outcomes rather than feel ensured that the target state operating model was implemented. Ensuring ongoing success was enabled via meaningful SLAs that directly drove compensation.

Financial Modeling

Actionable Strategies applied experience in financing for infrastructure projects at the national level. This involved modeling both budgets and net cash flows. As a bank, this type of financial analysis was critical in evaluating the program.

Business Results

The optimization initiative was an all-around success, but unheralded because it was not disruptive. Program planning and iterative executions de-risked the initiative and delivered early, quantifiable results.

Initial optimization delivered $27.6 million in savings with improved service delivery. Funding was freed up for innovation and change-the-bank initiatives.

Additional optimization produced recurring savings exceeding $15 million annually. This led line-of-business CIOs to adopt a similar strategy.

Actionable Strategies benchmarked initial spending and the ratio in the target state operating model. The client moved from lagging in new development/innovation to achieving industry norms.

This software company provides human capital management applications hosted in the Cloud. Marketing and sales were ad-hoc and revenue growth was stagnating. The situation demanded digital transformation to reach the small and mid-sized market segments. The client now has an end-to-end digital marketing and integrated sales process on the leading CRM and digital marketing platform. Marketing and sales use a single platform providing visibility of the sales funnel across the organization.

This software company provides human capital management applications hosted in the Cloud. Marketing and sales were ad-hoc and revenue growth was stagnating. The situation demanded digital transformation to reach the small and mid-sized market segments. The client now has an end-to-end digital marketing and integrated sales process on the leading CRM and digital marketing platform. Marketing and sales use a single platform providing visibility of the sales funnel across the organization.

Revenue is now forecast with greater accuracy. Metrics such as Customer Acquisition Cost and Customer Lifetime Value facilitate better investment decisions. This transformation will enable the client to grow and scale up both marketing and sales activities without constraints.

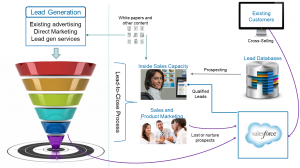

Transformation to digital marketing and sales required an evolutionary plan. Laying a foundation and then executing and improving over time enabled a smooth transformation from ad-hoc to digital and optimized.

Sales and Marketing Process

A defined inside lead generation process was created and initiated immediately. This function flowed qualified leads to senior sales professionals to develop and close. A raw implementation of Salesforce.com was used to capture leads while the enterprise migrated from two other CRM systems, one of which was homegrown.

Salesforce Implementation

After definition of the full sales funnel that encompasses all of the products, the existing CRM data was loaded into a customized Salesforce implementation that supported the minor process variations across products and all professional services.

After definition of the full sales funnel that encompasses all of the products, the existing CRM data was loaded into a customized Salesforce implementation that supported the minor process variations across products and all professional services.

The next step was to migrate all marketing into Pardot using defined customer journeys that reflected the different products and potential paths in the lead-close process.

Integration

Linkage of end-to-end processes required integration. This included connection to the customer management system used to support existing customers.

Metrics

Metrics were defined at various stages of the funnel and for strategic purposes. At the top level, historical data was mined to determine:

- Customer acquisition cost

- Average customer tenure

- Customer lifetime value

Operationally, process metrics were applied to manage the business. Most importantly, visibility was gained into the depth and shape of the sales funnel.

- Sales cycle and time in each stage of the funnel

- Close rate and loss rate in each stage of the funnel

Outbound Marketing

Outbound marketing did not previously exist but was embraced by the company. Despite being a greenfield sub-project, it remained challenging to develop the required capabilities.

Process: Automated and integrated marketing using Salesforce and Pardot.

Drop Marketing: e-mail driven customer journeys.

Content: Development of digital content used across marketing touchpoints.

Marketing Partners

Increased execution capabilities were added using outside firms. The partners provided internal capacity and also help at customer touchpoints.

View the full case study for further details.

The Government of Romania sought to deliver healthcare efficiently to historically underserved areas of the country. The majority of the population lives in rural areas or remote areas of the country with limited access to healthcare. Actionable Strategies assessed the viability of telemedicine to provide healthcare throughout Romania. The project resulted in funding for the initiative which initially saved several rural hospitals from closure and led to broad adoption of telemedicine.

The Government of Romania sought to deliver healthcare efficiently to historically underserved areas of the country. The majority of the population lives in rural areas or remote areas of the country with limited access to healthcare. Actionable Strategies assessed the viability of telemedicine to provide healthcare throughout Romania. The project resulted in funding for the initiative which initially saved several rural hospitals from closure and led to broad adoption of telemedicine.

Deliverables to the Ministry of Health included:

- Strategic Roadmap including benchmarking objectives

- Technology Strategy leading to eHealth services

- Implementation Plan covering: technology, operations, organization, financial, regulatory and citizen impact

Stakeholders in addition to the Ministry of Health:

- National Health Insurance House

- Ministry of Communications and Information Society

- Special Telecommunications Services

- Ministry of Finance

- 10 large hospitals

Information management required the implementation of national Electronic Medical Records. All technology had to be integrated with many legacy systems implemented in different municipalities.

The project achieved the Government Of Romania’s objectives:

The project achieved the Government Of Romania’s objectives:

- Improve the efficiency of specialized care in rural areas

- Counter the effects of the decision to close hospitals and turn them into homes for the elderly

- Increase access of the patients from rural areas to the low number of medical specialists in chronic diseases (for example Parkinson’s disease, diabetes, hypertension, etc.).

- In addition, the project aligns to the objectives of the EU eHealth Action Plan 2012-2020

The EU funded the Romanian government to implement a telemedicine network for people in rural areas. Facing conversion to nursing homes, several rural hospitals instead remained open as a result of this project.

As a global, multi-asset class broker/dealer, the European firm has dozens of offices worldwide with technology strategy driven from the U.S.. Asset classes include fixed income/rates, FX, equities and indexes, and commodities (softs, metals and energy). The Global Executive Committee sought business gains offered by transforming IT using Cloud Computing. Actionable Strategies was engaged to develop the strategy and transformation plan including the transformed operating model, financial models and risk assessment.

As a global, multi-asset class broker/dealer, the European firm has dozens of offices worldwide with technology strategy driven from the U.S.. Asset classes include fixed income/rates, FX, equities and indexes, and commodities (softs, metals and energy). The Global Executive Committee sought business gains offered by transforming IT using Cloud Computing. Actionable Strategies was engaged to develop the strategy and transformation plan including the transformed operating model, financial models and risk assessment.

The CIO stated: “Actionable Strategies partnered with us to synthesize a crisp business case from a large set of global business considerations. We used their planning framework to define a strategic roadmap that encompassed an aligned business and technology model. They brought a knowledge of financial services and depth of technical experience that enabled us to work effectively together.”

Actionable Strategies created the strategy for a Smart Grid in Myanmar. Initially focused in the capital, Yangon, a roadmap was developed which progressed from grid modernization to support for Smart Cities in Myanmar. The Smart Grid roadmap led to a proposal for project financing requiring approval from diverse stakeholders including state owned transmission and distribution companies. Ultimately, the Ministry of Electricity and Energy approved the strategic plan that included quantified benefits, risks, and financial projections.

Actionable Strategies created the strategy for a Smart Grid in Myanmar. Initially focused in the capital, Yangon, a roadmap was developed which progressed from grid modernization to support for Smart Cities in Myanmar. The Smart Grid roadmap led to a proposal for project financing requiring approval from diverse stakeholders including state owned transmission and distribution companies. Ultimately, the Ministry of Electricity and Energy approved the strategic plan that included quantified benefits, risks, and financial projections.

Initial implementation in 10 townships of $200 million was secured. Additional debt financing of $500 million was arranged for subsequent expansion. Unfortunately, the Coup d’État occurred two days before the Minister could formally sign the required approval and bankable concession agreement.

Actionable Strategies articulated benefits across several dimensions: Economic, Social, Environmental, Critical Infrastructure and Human Capacity. These aligned with UN Sustainable Development Goals and Myanmar’s Sustainable Development Plan. The project supported Myanmar’s commitment to the UN Paris Climate Accord.

The client makes debt and equity investments in real estate in New York State. The company provides construction financing, mortgage lending and equity capital. Since 1974 it has invested $10.5 billion, creating housing for 965,000 people. Actionable Strategies was referred to transform the IT organization. IT services were not meeting the needs of end users, costs were increasing while service levels were falling, and turnover was rising.

The client makes debt and equity investments in real estate in New York State. The company provides construction financing, mortgage lending and equity capital. Since 1974 it has invested $10.5 billion, creating housing for 965,000 people. Actionable Strategies was referred to transform the IT organization. IT services were not meeting the needs of end users, costs were increasing while service levels were falling, and turnover was rising.

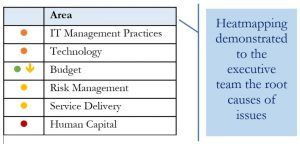

After presenting a heatmap of the major issues, we formulated a strategic plan which we then helped execute. The client successfully completed the transformation and addressed the key gaps: Strategic Alignment, Human Capital, Governance, Analytics and Budget.

Client Profile

The client makes debt and equity investments in real estate in New York State. The company provides construction financing, mortgage lending and equity capital. Since 1974 it has invested $10.5 billion, creating housing for 965,000 people.

Business Challenge

After summarily dismissing the head of IT, the company was referred to Actionable Strategies to assess the situation and take action. IT services were not meeting the needs of end users, costs were increasing while service levels were falling, and IT turnover was rising. There were a series of critical infrastructure failures and numerous areas of technology risk, but there were no concrete plans to enact needed changes. The CEO demanded a resolution.

Solution Approach

Senior consultants immediately took charge of the department, and provided interim CIO and day-to-day management services. Actionable Strategies assessed the situation and developed near-term plans and a strategic technology plan.

Senior consultants immediately took charge of the department, and provided interim CIO and day-to-day management services. Actionable Strategies assessed the situation and developed near-term plans and a strategic technology plan.

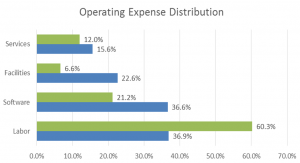

Benchmarking budgets across a number of dimensions identified that the client was increasing budgets but in the wrong areas. Service providers were charging more while outages were increasing. Software costs were bloated as the client attempted to extend an antiquated system rather than building out new capabilities and loading in legacy data.

Benchmarking budgets across a number of dimensions identified that the client was increasing budgets but in the wrong areas. Service providers were charging more while outages were increasing. Software costs were bloated as the client attempted to extend an antiquated system rather than building out new capabilities and loading in legacy data.

By describing the problem in business terms, Actionable Strategies was given the mandate for immediate action which established the foundation for the IT Strategic Plan.

Strategic Plan

Entering the next year, the client began executing on the IT Strategic Plan which included:

- Human Capital: Actionable Strategies drove selection of a new CIO and IT management team

- Alignment: The IT Strategic Plan mapped to business strategy including growth of locations across the state

- Governance: Strong management, supervision and reporting over vendors and internal IT

- Analytics: Modern analytical technologies were delivered faster and less expensively

- Budget: Reallocation of budgets increased service levels and reliability while delivering new capabilities

This European financial services firm operates in over 50 countries and is a primary market maker on the sell side. It provides wealth management, banking, asset management and investment banking services to institutions and individuals. Actionable Strategies was referred to the U.S. Investment Bank based on successful operational improvement projects at other top-tier banks.

Our mission was to manage a fractured set of manual regulatory processes, identify improvement opportunities and manage a program that optimized processes and delivered technology-based solutions. The project yielded sustainable benefits and resulted in referrals for business in other areas of the bank.

Business Challenge

To meet regulatory deadlines, the bank was forced to implement numerous inefficient and manual processes. The errors in processing and bad data introduced escalating costs and slower processing times. Actionable Strategies was engaged to manage the fractured sub-processes and introduce improvements.

To meet regulatory deadlines, the bank was forced to implement numerous inefficient and manual processes. The errors in processing and bad data introduced escalating costs and slower processing times. Actionable Strategies was engaged to manage the fractured sub-processes and introduce improvements.

Stakeholders spanned the front, middle and back offices. Financial instruments include both listed and OTC products. There were two major beneficiaries of the project.

- Americas Regulatory team who rolled up into the Global Regulatory Management team

- Centralized data services group

The most significant issues arose as a result of U.S. regulations:

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- FATCA (The Foreign Account Tax Compliance Act)

- Volcker rule of Dodd-Frank

Engagement Responsibilities

Actionable Strategies was engaged to manage end-to- end project lifecycle delivery across a set of process improvement initiatives. The most important activities included:

Actionable Strategies was engaged to manage end-to- end project lifecycle delivery across a set of process improvement initiatives. The most important activities included:

- Program management, PMO tracking and individual project oversight

- Regulatory requirements capture

- Impact assessment comprising both current state and gap analysis

- Stakeholder management and business analysis

- Business requirements capture

- Coordination of funding assessment and securing budgets

- Tracking of solution delivery encompassing:

- System design

- Process enhancements

- Execution of IT implementation and process changes

Solutions Delivered

After stabilizing the processes that were rushed into place, Actionable Strategies proceeded to identified waste and inefficiency. We then managed improvement projects to deliver tangible business results. These were measured by metrics established during project definition.

Client-facing Processes

Redundant client communications were disruptive from the initial implementation of regulations but did not abate. Traders, client on-boarding, prime brokerage and relationship managers were all contacting clients. In general, they were asking the same questions leading to growing frustration. Communication processes were streamlined to tamp down client dissatisfaction.

Redundant client communications were disruptive from the initial implementation of regulations but did not abate. Traders, client on-boarding, prime brokerage and relationship managers were all contacting clients. In general, they were asking the same questions leading to growing frustration. Communication processes were streamlined to tamp down client dissatisfaction.

Internal Processes

Process improvements opportunities were numerous and found throughout the organization. Duplicate processes were identified and consolidated to eliminate waste and the chance of errors.

Process improvements opportunities were numerous and found throughout the organization. Duplicate processes were identified and consolidated to eliminate waste and the chance of errors.

Errors in the onboarding process often were not detected until the middle office checked the work. Bullet-proof onboarding the initial process reduced the cost of onboarding and lowered the cycle times. Process rigidity was addressed to prevent hedge funds with less regulations from being flagged and then manually cleared.

Errors in the onboarding process often were not detected until the middle office checked the work. Bullet-proof onboarding the initial process reduced the cost of onboarding and lowered the cycle times. Process rigidity was addressed to prevent hedge funds with less regulations from being flagged and then manually cleared.

Excessive overhead needed to be aggressively removed. In some instances, after local approvals were received 10-15 offshore reviews were then applied. Bottlenecks often crippled the OTC review process.

Excessive overhead needed to be aggressively removed. In some instances, after local approvals were received 10-15 offshore reviews were then applied. Bottlenecks often crippled the OTC review process.

Technology Integration

Systems required integration and consolidation. In one example, electronic trading for credit products did not flow data downstream for confirmations and allocations. In an end user example, there were multiple PIN platforms causing friction in processes and security vulnerabilities as users posted security credentials on monitors.

Systems required integration and consolidation. In one example, electronic trading for credit products did not flow data downstream for confirmations and allocations. In an end user example, there were multiple PIN platforms causing friction in processes and security vulnerabilities as users posted security credentials on monitors.

Automated Processes

Manual and fractured processes necessitated automated end-to-end processes. Applying technology facilitated visibility by enabling report generation and real-time process metrics. Actionable Strategies defined these processes and wrote business requirements encompassing process, data quality, cycle time and auditing issues.

Manual and fractured processes necessitated automated end-to-end processes. Applying technology facilitated visibility by enabling report generation and real-time process metrics. Actionable Strategies defined these processes and wrote business requirements encompassing process, data quality, cycle time and auditing issues.

Process Management

Ongoing management of issues was a significant operating cost. An issue management system was defined to consolidate numerous spreadsheets used in manual tracking.

Ongoing management of issues was a significant operating cost. An issue management system was defined to consolidate numerous spreadsheets used in manual tracking.

Automated workflows replaced e-mail as the method for routing requests. This enabled real-time tracking and visibility into process status.

Visibility outside the process was enhanced. Automated notifications to requesters kept them informed but also obviated the need to contact staff. This increased the usable capacity. Response time for exceptions was also enhanced. If a change resulted in non-compliance with Dodd Frank or FATCA, an automated notice would be generated for the appropriate management staff.

Workflow management enabled workforce optimization. For example, supervisors were able to assign work to specific individuals given the situation. This provided balancing capabilities and prevented bottlenecks.

Capacity management was enabled globally. Centralized distribution of work was now possible across regions. Similar to trading, middle and back office staff were able to pass the book cleanly without breaks. This enable processes to finish without long wait times between steps.

Business Results

Process improvement and automation results led to demonstrable business results measured by metrics established when Actionable Strategies took charge of the manual processes.

Process improvement and automation results led to demonstrable business results measured by metrics established when Actionable Strategies took charge of the manual processes.

The most significant benefits were perpetual and included:

- Reduced processing times

- Lower staffing costs

- Improved processing with fewer errors

- Burndown of the large backlog of requests

- Elimination of redundant processing steps

- Management visibility into process metrics

- Alleviation of pressure on front-line leaders related to operational issues

Actionable Strategies was engaged in other areas of the bank as a result of the successes delivered.