Financial Services Industry

Actionable Strategies work on both the buy and sell sides of the industry gives us a broad view to assist our clients. Our consultants have worked at large institutions, smaller trading firms, advisors and vendors including FinTech. Our experience with other asset classes includes real estate and energy.

Our work ranges from critical strategies to hands-on transformation of back office processes and implementation of technologies. In addition to major markets such as New York and London, we have experience in emerging markets in Asia and South America. Clients turn to us for unbiased advice and counsel combined with the ability to act quickly and decisively.

Jeffrey Wu, CEO of Actionable Strategies, appeared via video at Cashless Africa in Abuja, Nigeria. He discussed the opportunities for Africa to advance economic inclusion and economic development by leapfrogging traditional finance into the digital realm.

While acknowledging the potential, Mr. Wu also offered a number of prerequisites for success. These include a viable operating model, critical mass of adoption, scalability, and trust. It was noted that the underlying technologies are proven, but in Africa there is lagging adoption which constrains the ability to develop more advanced applications.

Mr. Wu shared conversations with Africa business leaders in which access to capital was cited as a constraint. He noted that capital generally flows freely and a large population and a new technology are not enough to attract capital. Failing to distinguish the serviceable obtainable marker from the overall population was identified as a business planning mistake.

Lack of planning for ramped up adoption was also shared as a reason investors will not risk capital. This applies to both operational planning as well as driving adoption across stakeholders. Mr. Wu shared the importance of addressing all stakeholders, not just customers: merchants, especially small ones who constitute the large informal economy, and government entities who act as both payors and payees.

This global investment bank advises, originates, trades, manages and distributes capital for governments, institutions and individuals. The client offers global electronic trading across cash equities, options, and futures.

This global investment bank advises, originates, trades, manages and distributes capital for governments, institutions and individuals. The client offers global electronic trading across cash equities, options, and futures.

The client is competing with other prominent firms for dramatically lower trading volumes. To compete effectively and win, the client needed to attain a better understanding of key client needs and wants, articulate a roadmap to meet client requirements, and execute against this roadmap.

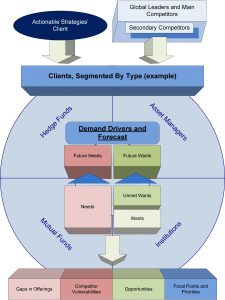

Actionable Strategies used a structured solution framework to assess competitors and target market.

Actionable Strategies used a structured solution framework to assess competitors and target market.

- Segment client base in alignment with strategy

- Determine current and future demand drivers: Basic needs (commoditized) or Wants (differentiators)

- Design and apply competitive analysis to extract vital information

After conducting competitive and market analysis, Actionable Strategies then provided specific product strategy recommendations to re-align product development work. The roadmap presented by Actionable Strategies guided the long-term vision for the product including mobile and tablet platforms. Actionable Strategies was subsequently engaged for further work with the client.

Client Profile

This global investment bank and financial services firm advises, originates, trades, manages and distributes capital for governments, institutions and individuals. The client offers global electronic trading across cash equities, options, and futures. The high touch sales, trading and market-making services are available around the world. Electronic trading tools include a broad suite of algorithms, smart order routing and direct market access.

Business Objective

The client is competing with other prominent firms for trading volumes that are dramatically lower than in previous years. To compete effectively and win vis-à-vis these other firms, the client needed to attain a better understanding of key client needs and wants, articulate a roadmap to meet client requirements, and execute against this roadmap.

Project Overview

Actionable Strategies used a structured solution framework to assess competitors and target market.

- Segment client base in alignment with strategy

- Determine current and future demand drivers

- Basic needs (commoditized)

- Wants (differentiators)

- Design and apply competitive analysis to extract the vital information

- Gap in our ability to meet needs

- Competitors gaps that we can exploit

- Opportunities to provide value add / differentiators

- Most critical areas to emphasize and invest resources

The client engaged Actionable Strategies for a number of reasons.

- Unbiased strategic expertise

- Knowledge of the global markets and participants

- Connections with buy-side clients

- Product and technology knowledge

- Process and financial experience

Project Structure

The project was executed in a number of phases.

Baseline

To drive research design, a market baseline was developed.

- Clients are first divided into segments with analysis focused on individual segments

- Certain segments will be more important

- Segments may not be targets and should be ignored (e.g., individual investors)

- Strategic focus should be supported by market characteristics (e.g., trading volume relative to AUM)

- Overlay segmentation is also a consideration (e.g., cash, operating region); client-oriented views such as long-only trading strategies vs. long-short should also play a role in understanding client needs and wants

- Internal SWOT analysis forms the baseline for each segment (or group of segments if we decide their behavior is similar)

The sample shows the segmentation approach but is not the exact models used with the client. Segmentation led to a SWOT analysis (strengths, weaknesses, opportunities and threats). In reality, the model was more complex and included overlay segmentation.

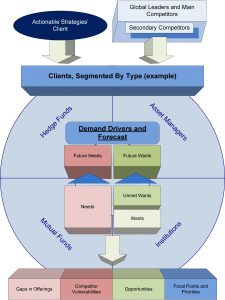

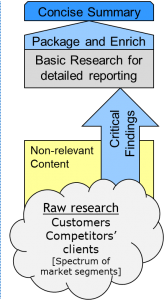

Design

The design phase created a plan for focused research. The objective was to provide concrete and actionable competitive intelligence. This enabled us to develop the most effective roadmap to win in the market. The following overall approach was applied to design.

- Consolidate internal and analysts views on the broader market

- Provides general trends and direction

- Narrow based on customer and competitors’ clients

- Identify specific needs and opportunities by segment

- Determine comparative competitive landscape

- Use targeted research to prove or disprove hypotheses about reaching clients and taking aware share

- Focus based on specific competitive objectives

- Align to strategy in terms of segment, approach and direction

- Distill to the vital few and prioritize

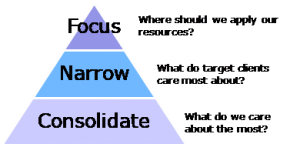

The following specific approach was used in research design. It was critical to apply multiple hypotheses per goal state as the research also disproved certain hypotheses.

- Based on goal states that align to strategy

- In this example below, take 5% net market share from Competitor S in the Hedge Fund segment for funds between $1B and $5B in AUM

- Create hypotheses that drive actionable plans

- In this example, if we supported a better algo than Sniper, we could convert Y% of the base while sustaining historical losses of Z% leading to A% takeaway

- Generate research approaches that prove or disprove the hypotheses

By developing hypotheses and a focused research approach, meaningful results are attained.

Competitive Research

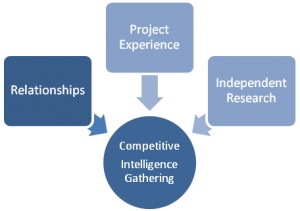

Actionable Strategies conducted competitive research by directly contacting clients and prospects. The following were the key elements of this approach.

- Identify current and longer term needs and wants

- Negative cases are sought and are highly valuable

- Reasons for rejecting competitors / client

- Constraints in selecting client

- Utilize consulting firm strengths

- Experience from other projects

- Relationships at other institutions

- Ability to conduct independent research

Independent research used the following proven approach.

- Proven bespoke research methods

- Contact clients and prospects to conduct research

- Quid pro quo is anonymous results

- Client receives specific information

- Efficient and ethical

By leveraging the strengths of Actionable Strategies, the client realized tremendous value in a compressed timeframe and efficient cost structure.

The following were sources for research which provided a broad market footprint.

- Draw from first level contacts

- Use second level network to create a larger footprint

- Option of using academic contacts to execute broad based research

- Ability to engage client contacts that client staff might not be able converse with directly

Research Analysis

The analysis phase produced the end product for the heads of the business and their executive team.

- Distill raw research into salient findings aligned to hypotheses

- Package into a concise summary

- Crisp encapsulation

- Graphical elements

- Drill downs follow

- Retain basic research for appendices

Key Takeaways

Takeaways from the project need to be non-specific due to the confidential nature of the work. However, the reader can benefit from the value derived by the client.

- Certain hypotheses about client wants were not substantiated by direct conversations – this enabled the client to preserve investment in product development related to requirements that had no value in the market

- Competitive positioning and perceived valued may have differed from reality, but clients and prospects did believe competitive messaging and the opinions of peer institutions – this enabled the client to focus marketing and sales efforts in demonstrating their superior value in those areas

- Segmentation of the market revealed needs specific to given targets – this enabled the client to make informed investment decisions as well as tailor marketing messages by segment

- Product gaps, both real and perceived, were clearly identified – this enabled the client to prioritize product development and enable product support to address perceived gaps

- Executives were highly focused on the executive summary and the detailed information was used for drill-down discussions only; front-line leaders went through all of the detailed research and findings

Business Results

The client used the competitive product strategy recommendations to re-align product development work. The roadmap presented by Actionable Strategies guided the long-term vision for the product including mobile and tablet platforms. Actionable Strategies was engaged for further work with the client.

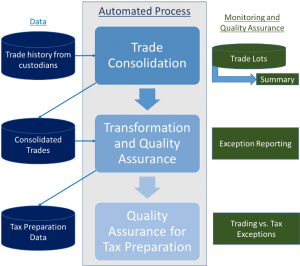

One of the 50 largest financial planning firms, the client is rated a top firm by Worth Magazine. As the firm grew, many manual processes became unwieldy and costly. Applying Lean principles, Actionable Strategies automated processes to ingest trading and charitable donation data, process it into usable tax information and feed it into the tax software platform. The client realized an ongoing reduction in processing time, costs and error rates.

One of the 50 largest financial planning firms, the client is rated a top firm by Worth Magazine. As the firm grew, many manual processes became unwieldy and costly. Applying Lean principles, Actionable Strategies automated processes to ingest trading and charitable donation data, process it into usable tax information and feed it into the tax software platform. The client realized an ongoing reduction in processing time, costs and error rates.

Detailed Client Profile

The client is a leading independently managed wealth management firm in New York City. They have been providing comprehensive wealth management services to their clients for over 25 years. As an independent, registered investment advisor, the firm provides sophisticated planning, investment management and highly integrated tax strategies. These services are highly personalized and serve high net worth individuals and families, as well as business owners, executives and entrepreneurs looking to grow their wealth.

The client is a leading independently managed wealth management firm in New York City. They have been providing comprehensive wealth management services to their clients for over 25 years. As an independent, registered investment advisor, the firm provides sophisticated planning, investment management and highly integrated tax strategies. These services are highly personalized and serve high net worth individuals and families, as well as business owners, executives and entrepreneurs looking to grow their wealth.

The client has been recognized as one of the Top Financial Advisory firms in America by Worth magazine and Medical Economics. Investment News called the firm one of the 50 Largest Financial Planning firms and Financial Advisor named them a Leading RIA firm.

Business Challenge

As the firm continued to grow, many of the manual processes became unwieldy and costly. As part of the range of advisory services delivered to their clients, the firm provided tax planning. This included a broad set of activities including return preparation, filings and accounting for charitable donations. Many of the activities required to provide these services were manual, requiring data entry and checking by experts on staff. While costly, these manual efforts still resulted in errors in generating tax returns.

As the firm continued to grow, many of the manual processes became unwieldy and costly. As part of the range of advisory services delivered to their clients, the firm provided tax planning. This included a broad set of activities including return preparation, filings and accounting for charitable donations. Many of the activities required to provide these services were manual, requiring data entry and checking by experts on staff. While costly, these manual efforts still resulted in errors in generating tax returns.

The firm sought to reduce the significant cost, time and effort required to manually process trades and other transactions for tax preparation.

Solution Approach

Actionable Strategies provided specific expertise to design and develop an automated process to turn raw trading and financial transactions into tax information. Experience with Lean process, data analytics and application integration allowed Actionable Strategies to rapidly deliver a solution that:

Actionable Strategies provided specific expertise to design and develop an automated process to turn raw trading and financial transactions into tax information. Experience with Lean process, data analytics and application integration allowed Actionable Strategies to rapidly deliver a solution that:

- Extracts stock, bond and other trades as well as other financial activity from custodians who hold the assets on behalf of the client

- Consolidates trading and other data into tax lots by types of assets and transaction type

- Transforms consolidated trading data into tax information for loading into the tax system

- Identifies the source of any discrepancies

Business Results

The automated process delivered ongoing benefits.

- Eliminated cost from personnel entering data

- Reduced the time to determine tax liabilities and prepare returns for filing

- Eliminated quality issues from data errors

- Reduced oversight requirements from senior management

- Enabled the Lean, straight-through process to operate in future years, even with data and technology changes

As a global, multi-asset class broker/dealer, the European firm has dozens of offices worldwide with technology strategy driven from the U.S.. Asset classes include fixed income/rates, FX, equities and indexes, and commodities (softs, metals and energy). The Global Executive Committee sought business gains offered by transforming IT using Cloud Computing. Actionable Strategies was engaged to develop the strategy and transformation plan including the transformed operating model, financial models and risk assessment.

As a global, multi-asset class broker/dealer, the European firm has dozens of offices worldwide with technology strategy driven from the U.S.. Asset classes include fixed income/rates, FX, equities and indexes, and commodities (softs, metals and energy). The Global Executive Committee sought business gains offered by transforming IT using Cloud Computing. Actionable Strategies was engaged to develop the strategy and transformation plan including the transformed operating model, financial models and risk assessment.

The CIO stated: “Actionable Strategies partnered with us to synthesize a crisp business case from a large set of global business considerations. We used their planning framework to define a strategic roadmap that encompassed an aligned business and technology model. They brought a knowledge of financial services and depth of technical experience that enabled us to work effectively together.”

This European financial services firm operates in over 50 countries and is a primary market maker on the sell side. It provides wealth management, banking, asset management and investment banking services to institutions and individuals. Actionable Strategies was referred to the U.S. Investment Bank based on successful operational improvement projects at other top-tier banks.

Our mission was to manage a fractured set of manual regulatory processes, identify improvement opportunities and manage a program that optimized processes and delivered technology-based solutions. The project yielded sustainable benefits and resulted in referrals for business in other areas of the bank.

Business Challenge

To meet regulatory deadlines, the bank was forced to implement numerous inefficient and manual processes. The errors in processing and bad data introduced escalating costs and slower processing times. Actionable Strategies was engaged to manage the fractured sub-processes and introduce improvements.

To meet regulatory deadlines, the bank was forced to implement numerous inefficient and manual processes. The errors in processing and bad data introduced escalating costs and slower processing times. Actionable Strategies was engaged to manage the fractured sub-processes and introduce improvements.

Stakeholders spanned the front, middle and back offices. Financial instruments include both listed and OTC products. There were two major beneficiaries of the project.

- Americas Regulatory team who rolled up into the Global Regulatory Management team

- Centralized data services group

The most significant issues arose as a result of U.S. regulations:

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- FATCA (The Foreign Account Tax Compliance Act)

- Volcker rule of Dodd-Frank

Engagement Responsibilities

Actionable Strategies was engaged to manage end-to- end project lifecycle delivery across a set of process improvement initiatives. The most important activities included:

Actionable Strategies was engaged to manage end-to- end project lifecycle delivery across a set of process improvement initiatives. The most important activities included:

- Program management, PMO tracking and individual project oversight

- Regulatory requirements capture

- Impact assessment comprising both current state and gap analysis

- Stakeholder management and business analysis

- Business requirements capture

- Coordination of funding assessment and securing budgets

- Tracking of solution delivery encompassing:

- System design

- Process enhancements

- Execution of IT implementation and process changes

Solutions Delivered

After stabilizing the processes that were rushed into place, Actionable Strategies proceeded to identified waste and inefficiency. We then managed improvement projects to deliver tangible business results. These were measured by metrics established during project definition.

Client-facing Processes

Redundant client communications were disruptive from the initial implementation of regulations but did not abate. Traders, client on-boarding, prime brokerage and relationship managers were all contacting clients. In general, they were asking the same questions leading to growing frustration. Communication processes were streamlined to tamp down client dissatisfaction.

Redundant client communications were disruptive from the initial implementation of regulations but did not abate. Traders, client on-boarding, prime brokerage and relationship managers were all contacting clients. In general, they were asking the same questions leading to growing frustration. Communication processes were streamlined to tamp down client dissatisfaction.

Internal Processes

Process improvements opportunities were numerous and found throughout the organization. Duplicate processes were identified and consolidated to eliminate waste and the chance of errors.

Process improvements opportunities were numerous and found throughout the organization. Duplicate processes were identified and consolidated to eliminate waste and the chance of errors.

Errors in the onboarding process often were not detected until the middle office checked the work. Bullet-proof onboarding the initial process reduced the cost of onboarding and lowered the cycle times. Process rigidity was addressed to prevent hedge funds with less regulations from being flagged and then manually cleared.

Errors in the onboarding process often were not detected until the middle office checked the work. Bullet-proof onboarding the initial process reduced the cost of onboarding and lowered the cycle times. Process rigidity was addressed to prevent hedge funds with less regulations from being flagged and then manually cleared.

Excessive overhead needed to be aggressively removed. In some instances, after local approvals were received 10-15 offshore reviews were then applied. Bottlenecks often crippled the OTC review process.

Excessive overhead needed to be aggressively removed. In some instances, after local approvals were received 10-15 offshore reviews were then applied. Bottlenecks often crippled the OTC review process.

Technology Integration

Systems required integration and consolidation. In one example, electronic trading for credit products did not flow data downstream for confirmations and allocations. In an end user example, there were multiple PIN platforms causing friction in processes and security vulnerabilities as users posted security credentials on monitors.

Systems required integration and consolidation. In one example, electronic trading for credit products did not flow data downstream for confirmations and allocations. In an end user example, there were multiple PIN platforms causing friction in processes and security vulnerabilities as users posted security credentials on monitors.

Automated Processes

Manual and fractured processes necessitated automated end-to-end processes. Applying technology facilitated visibility by enabling report generation and real-time process metrics. Actionable Strategies defined these processes and wrote business requirements encompassing process, data quality, cycle time and auditing issues.

Manual and fractured processes necessitated automated end-to-end processes. Applying technology facilitated visibility by enabling report generation and real-time process metrics. Actionable Strategies defined these processes and wrote business requirements encompassing process, data quality, cycle time and auditing issues.

Process Management

Ongoing management of issues was a significant operating cost. An issue management system was defined to consolidate numerous spreadsheets used in manual tracking.

Ongoing management of issues was a significant operating cost. An issue management system was defined to consolidate numerous spreadsheets used in manual tracking.

Automated workflows replaced e-mail as the method for routing requests. This enabled real-time tracking and visibility into process status.

Visibility outside the process was enhanced. Automated notifications to requesters kept them informed but also obviated the need to contact staff. This increased the usable capacity. Response time for exceptions was also enhanced. If a change resulted in non-compliance with Dodd Frank or FATCA, an automated notice would be generated for the appropriate management staff.

Workflow management enabled workforce optimization. For example, supervisors were able to assign work to specific individuals given the situation. This provided balancing capabilities and prevented bottlenecks.

Capacity management was enabled globally. Centralized distribution of work was now possible across regions. Similar to trading, middle and back office staff were able to pass the book cleanly without breaks. This enable processes to finish without long wait times between steps.

Business Results

Process improvement and automation results led to demonstrable business results measured by metrics established when Actionable Strategies took charge of the manual processes.

Process improvement and automation results led to demonstrable business results measured by metrics established when Actionable Strategies took charge of the manual processes.

The most significant benefits were perpetual and included:

- Reduced processing times

- Lower staffing costs

- Improved processing with fewer errors

- Burndown of the large backlog of requests

- Elimination of redundant processing steps

- Management visibility into process metrics

- Alleviation of pressure on front-line leaders related to operational issues

Actionable Strategies was engaged in other areas of the bank as a result of the successes delivered.

The client processes large volumes of data from over 15,000 institutions across many asset classes traded around the world. It provides aggregated data including illiquid assets and advanced reporting services to investment advisors and family offices. Actionable Strategies designed and developed Cloud data analytics integrated into Salesforce.com for a seamless user experience. Agile product development rapidly delivered successive versions of software using a cost effective hybrid onshore/offshore development team.

The client processes large volumes of data from over 15,000 institutions across many asset classes traded around the world. It provides aggregated data including illiquid assets and advanced reporting services to investment advisors and family offices. Actionable Strategies designed and developed Cloud data analytics integrated into Salesforce.com for a seamless user experience. Agile product development rapidly delivered successive versions of software using a cost effective hybrid onshore/offshore development team.

Client Profile

The client processes large volumes of data from over 15,000 institutions across many asset classes traded around the world. It provides aggregated data, including illiquid assets, and advanced reporting services to investment advisors and family offices.

Business Objective

Allowing wealth management professionals to use advanced reporting and charting capabilities requires a flexible technology platform that does not drive up operating costs as growth is achieved.

Allowing wealth management professionals to use advanced reporting and charting capabilities requires a flexible technology platform that does not drive up operating costs as growth is achieved.

The client had established itself as a data provider but delivering analytical and reporting capabilities was lagging. Providing integrated data and reporting on a workstation was no longer viable using technology implemented on the desktop. Achieving a scalable Cloud model was the only way to meet customer needs and achieve profitability.

Solution Delivered

Traditional Business Intelligence platforms provide powerful capabilities with software installed locally. However, building a scalable business model cannot rely on the installation of complex desktop software. With a customer base of any reasonable size, the deployment and support of an installed technology solution adds operational costs that grow with the size of the customer base.

Traditional Business Intelligence platforms provide powerful capabilities with software installed locally. However, building a scalable business model cannot rely on the installation of complex desktop software. With a customer base of any reasonable size, the deployment and support of an installed technology solution adds operational costs that grow with the size of the customer base.

Consultants from Actionable Strategies had already developed automated data ingestion from a variety of data sources. In operations, we had worked on process optimization and data quality management.

Consultants from Actionable Strategies had already developed automated data ingestion from a variety of data sources. In operations, we had worked on process optimization and data quality management.

Our knowledge of the clients business and technology was combined with our expertise in Cloud computing models to provide a business solution that would scale with the client customer base.

Integrated User Experience

Actionable Strategies provided the client with a solution that delivered robust functionality while containing expenses as the customer base scaled up. The technical solution was embedded into Salesforce.com, the leading CRM platform. This solution prompted the client to pursue integration with other vendors serving specific target markets.

Actionable Strategies provided the client with a solution that delivered robust functionality while containing expenses as the customer base scaled up. The technical solution was embedded into Salesforce.com, the leading CRM platform. This solution prompted the client to pursue integration with other vendors serving specific target markets.

Salesforce.com Integration

Leveraging our experience with Salesforce.com, we designed and developed an integrated solution that provided a seamless experience when working on a client account. We embedded the client’s product set so that aggregated financial data appeared as part of an account record in Salesforce. Hovering over thumbnails of charts popped up the analytical screen for that chart.

Leveraging our experience with Salesforce.com, we designed and developed an integrated solution that provided a seamless experience when working on a client account. We embedded the client’s product set so that aggregated financial data appeared as part of an account record in Salesforce. Hovering over thumbnails of charts popped up the analytical screen for that chart.

This provided Wealth Managers and Investment Advisors with a single platform to understand their complex client relationships delivered seamlessly in the Cloud.

(The screen is a prototype using dummy data.)

Agile Process

Applying an Agile approach, Actionable Strategies delivered working software every iteration so the client could ensure marketing requirements were met and progress was tracking to plan. Initial iterations ran for 2 weeks, but this was reduced to 1 week after a good cadence was established. Iterations were packaged into frequent releases for more formal review by product management and marketing.

Applying an Agile approach, Actionable Strategies delivered working software every iteration so the client could ensure marketing requirements were met and progress was tracking to plan. Initial iterations ran for 2 weeks, but this was reduced to 1 week after a good cadence was established. Iterations were packaged into frequent releases for more formal review by product management and marketing.

Global Delivery Model

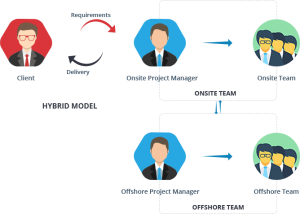

Utilizing a hybrid onshore/offshore development team, we rapidly delivered a solution in a cost-effective manner.

Utilizing a hybrid onshore/offshore development team, we rapidly delivered a solution in a cost-effective manner.

The project manager worked directly with the client team while the development team was based in China. The PM shared day-to-day responsibilities with the iteration manager in China who was fluent in English. The offshore team was composed of bilingual and native Chinese speakers. This structure has proven successful for us because it minimizes communication problems. Instant messaging and other collaboration tools provided ongoing dialog, but the time difference always presents a challenge.

Results

After successfully launching the initial solution, the client continued to develop advanced analytical capabilities.

- Using Agile development, Actionable Strategies delivered versions 1.0-1.5 and then the next major version 2.0.

- After 2 major releases, the entire process, codebase and development environment was documented and turned over to the client.

- Success in moving the product to the Cloud and introducing Agile led the client to engage Actionable Strategies for further work in both process and technology.

The client is now a leader in the reporting space. It has won awards for the technology from organizations such as the Wealth Management .com industry award.

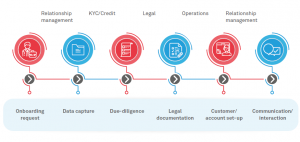

The client is a global bank and one of the ten largest in the world. Onboarding clients is a key process but presents significant challenges. The Change Management executive stated that he “needs what Actionable Strategies does” after an internal referral from the business. Actionable Strategies met both the stated needs of the client as well as a plethora of unplanned requirements.

The client is a global bank and one of the ten largest in the world. Onboarding clients is a key process but presents significant challenges. The Change Management executive stated that he “needs what Actionable Strategies does” after an internal referral from the business. Actionable Strategies met both the stated needs of the client as well as a plethora of unplanned requirements.

Client Profile

The client is a global bank and one of the ten largest in the world. Formed over 150 years ago, it operates nearly 4,000 offices in 67 countries. The bank has over 40 million customers.

Business Challenge

Onboarding clients is a key process but presents significant challenges. While the basic process is easily understood, the intricate details and permutations experienced by a large financial institution introduces significant complexity.

The client was establishing a global Center of Excellence headquartered in New York to ensure that onboarding was efficient, timely and met the myriad compliance regimes required around the world.

The client was establishing a global Center of Excellence headquartered in New York to ensure that onboarding was efficient, timely and met the myriad compliance regimes required around the world.

A Change Management program was established to ensure that the rollout successfully addressed all aspects of implementation.

- Process

- Technology

- Compliance

The Change Management executive stated that he “needs what Actionable Strategies does” after an internal referral from the business.

Transformation Services

In addition to bringing expertise in process, technology and banking compliance, Actionable Strategies met other needs expressed by the client:

- Client interaction including executive and front-line presentations, and leading workshops

- Financial analysis and budgeting

- Project management including project and program planning

Actionable Strategies engaged with numerous stakeholders across the bank. These stakeholders operated at all levels of the organization.

Examples of specific interactions with diverse functions include the following:

- Budget management including cost tracking reporting to the CFO in London

- Consulting in Transformation including Analytics Development and Presentation

- Change Management workshop delivery

- PMO integration

- Process development including reconciliation across sub-processes

- Business requirements specifications for asset management

Actionable Strategies met both the stated needs of the client as well as unplanned requirements. Based on the knowledge, experience and specific results delivered, the client made several referrals within the bank and to peer institutions.

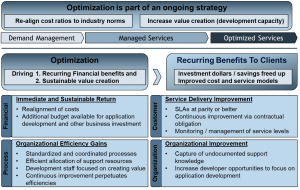

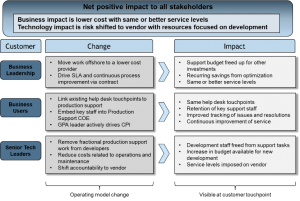

This global bank engages in a range of activities including safeguarding assets, lending money, making payments and accessing the capital markets on behalf of clients. The bank sought to improve performance and rationalize costs on a worldwide basis. Global Technology and Operation believed operations and maintenance spending was crowding out new investments in both technology and other areas.

This global bank engages in a range of activities including safeguarding assets, lending money, making payments and accessing the capital markets on behalf of clients. The bank sought to improve performance and rationalize costs on a worldwide basis. Global Technology and Operation believed operations and maintenance spending was crowding out new investments in both technology and other areas.

Actionable Strategies was engaged to tie together the strategic program delivering a target state operating model, transition processed, program plan, and metrics to measure progress and subsequently sustain improvements and cost savings.

The optimization initiative was an all-around success, but unheralded because it was not disruptive. Program planning and iterative executions de-risked the initiative and delivered early, quantifiable results. Initial optimization delivered $27.6 million in savings with improved service delivery. Funding was freed up for innovation and change-the-bank initiatives. Additional optimization produced recurring savings exceeding $15 million annually.

Client Profile

This global bank engages in a range of activities including safeguarding assets, lending money, making payments and accessing the capital markets on behalf of clients. The institution is 200 years old and has connected millions of people across hundreds of countries and cities.

Business Objective

The bank sought to improve performance and rationalize costs on a worldwide basis. As a global financial institution, technology investments are essential. As time passes, ongoing operations and maintenance spending can become an overwhelming portion of budget and crowd out new investments in both technology and other areas. Naturally, one of the largest budget areas that required scrutiny was the Global Technology and Operations organization.

The bank sought to improve performance and rationalize costs on a worldwide basis. As a global financial institution, technology investments are essential. As time passes, ongoing operations and maintenance spending can become an overwhelming portion of budget and crowd out new investments in both technology and other areas. Naturally, one of the largest budget areas that required scrutiny was the Global Technology and Operations organization.

Given the size and scope of the organization, assessing the opportunities for optimization were quite complex. Cost takeout was a consideration, but analyses needed to be conducted around the employee effects, internal customer impact, risks and change management. The executive in charge of the program engaged Actionable Strategies to help him tie together the many activities and convey it as a strategic program to executive leadership.

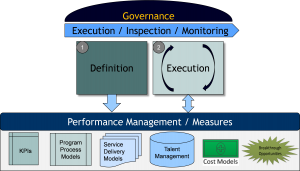

Project Overview

Optimization focused on ongoing “run-the-bank” activities related to technology such as infrastructure engineering and application maintenance and support. The target was to free up half of the RTB budget to fund additional investments in innovation and new applications.

The project had two distinct phases:

- Definition

- Assess resource models

- Transition process design and division of responsibilities

- Program plan and milestones

- Metrics development for transition and steady state operation

- Execution

- Milestone reporting to executives on progress and savings

- Monitor transition as each tranche is optimized

- Ongoing inspection of service delivery quality and cost.

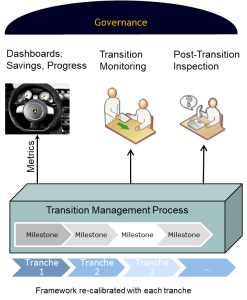

The engagement structure appears below.

Definition Phase

Definition provided three outcomes for the client.

- Validation: Ensure that the target state operating model is achievable considering many factors including:

- Reported time allocation

- Estimated future resource requirements

- Internal customer request flow and backlog

- Work absorbed in other areas that must be reclaimed

- Changes in overhead and coordination efforts

- Vendor models of effort

- Prove-out: Accurate calculation of an achievable ROI factoring in estimation variance and unplanned P&L impacts

- Planning: Detailed planning to enable the client to execute on transition with particular focus on definition of:

- Transition process included steps for all roles involved

- Human capital model included changes in responsibilities or organizational structure

- Milestone definition

- Metrics for reporting and ongoing monitoring

This target state operating model was critical to successful execution. The optimized operating model was expected to last for many years. Benefits would be recurring and anticipated to be large, enabling innovation and change-the-bank activities without new investments.

Execution Phase

Execution involved the transformation of individual functions grouped into tranches. These tranches were managed and monitored separately using a structured process defined in the definition phase.

Because of this structured process, execution went exceptionally smoothly.

Because of this structured process, execution went exceptionally smoothly.

- Milestone reviews flowed metrics into dashboards enabling the client to:

- Track savings

- Demonstrate progress

- Monitor transition activities within each tranche

- Inspect and verify of reported results

- Post-transition, inspect ongoing activities

- Confirm and ensure savings

- Report on additional breakthrough opportunities

Key Takeaways

While broad in scope, this initiative had similarities to other complex projects with diverse stakeholders.

Program Management

The PMO expended significant effort managing vendors and individual projects, necessitating the use of Actionable Strategies at a strategic level to link program activities and results to senior executives.

Operating model

The target state operating model was critical to success as with any transformational project. The key in this case was the focus on ensuring Service Delivery did not decline and that optimize would yield improvements.

Change Management

Transition planning combined with effective communication simplified the significant change in underlying operations. Planning to minimize disruption for internal customers enabled better results.

Effective Metrics

Implementing a measurement model focused on results facilitated effective management during transition and steady state operations. Managing transition by outcomes rather than feel ensured that the target state operating model was implemented. Ensuring ongoing success was enabled via meaningful SLAs that directly drove compensation.

Financial Modeling

Actionable Strategies applied experience in financing for infrastructure projects at the national level. This involved modeling both budgets and net cash flows. As a bank, this type of financial analysis was critical in evaluating the program.

Business Results

The optimization initiative was an all-around success, but unheralded because it was not disruptive. Program planning and iterative executions de-risked the initiative and delivered early, quantifiable results.

Initial optimization delivered $27.6 million in savings with improved service delivery. Funding was freed up for innovation and change-the-bank initiatives.

Additional optimization produced recurring savings exceeding $15 million annually. This led line-of-business CIOs to adopt a similar strategy.

Actionable Strategies benchmarked initial spending and the ratio in the target state operating model. The client moved from lagging in new development/innovation to achieving industry norms.

The client is among the top ten banks and asset managers globally. It was unable to accurately report enterprise wide risk and revenue by counterparty and country. The exposure posed an unacceptable business threat visible at the Board of Directors level.

The client is among the top ten banks and asset managers globally. It was unable to accurately report enterprise wide risk and revenue by counterparty and country. The exposure posed an unacceptable business threat visible at the Board of Directors level.

Actionable Strategies managed the program to successful completion: on schedule and within budget. The client was able to understand enterprise risk for the entire customer base.

Client Profile

The client is among the top ten banks and asset managers globally with a presence in 36 countries and over 100 markets. It deals with tens of trillions in assets for institutions and individuals. Services include banking, clearing, custody and asset management.

The client is among the top ten banks and asset managers globally with a presence in 36 countries and over 100 markets. It deals with tens of trillions in assets for institutions and individuals. Services include banking, clearing, custody and asset management.

Situation/Problem

The client was unable to accurately report enterprise wide risk and revenue by counterparty and country because of poor data quality in their central customer database. The exposure posed an unacceptable business threat visible at the Board of Directors level. Regulators from around the world also showed concern.

The underlying technical situation was an enterprise data management problem. The central customer database was actually composed of two legacy systems. After a merger, the combined bank continued to maintain data in both systems. This prevented effective reporting across the two systems. Data quality issues abounded as the databases were neither synchronized nor cleansed.

Multiple Legacy Systems

Information and processes exist in legacy systems confined to the heritage organizations where they were developed. In addition to multiple core banking systems, duplicate data was housed in clearing, asset management and capital markets systems.

Organizational Challenges

Business stakeholders all had their own interests. While the program executive managed the board and senior executives, he required strong support to manage the diverse stakeholders. Actionable Strategies was engaged because of our ability to work with executives, experience in banking and technical knowledge including legacy systems.

In-Flight Re-engineering

A strategic plan was formulated to re-engineer the customer database, while simultaneously remediating the data. Numerous projects were created to execute the plan. The basic categories included:

- Data modeling

- Data quality management

- Process re-engineering

- System renovation

- Vendor management

- Reporting and analytics

Re-engineering in-flight processes and systems is not only exceptionally difficult but requires vision across the organization and into the future.

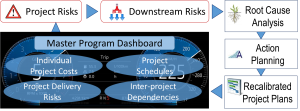

Program Risks

The plan faced several significant implementation risks.

- Coordination across multiple technology and business teams as well as outside contractors

- Significant reengineering of business processes to enforce data quality at the source

- Remediation of existing data before application controls could be put in place, meaning data could not be maintained in its remediated state

- Solution depended on assumptions about the current and future state that could only be verified as the program proceeded

Approach/Solution

Actionable Strategies identified the critical program deliverables, assessed their current status and schedule, cost and delivery risk as well as their dependencies on other deliverables. These findings were distilled into a program dashboard that provided clear indication as to what aspects of the program presented the greatest risks and what those risks implied for other elements of the program. A streamlined process was then established to refine the program against its objectives on a monthly basis.

The program dashboard identified critical areas of significant risk to enable root cause analysis. This identified the principal contributors to those risks and advised the program sponsor on specific actions to address those sources.

As key assumptions regarding the data remediation approach were found to be sub-optimal, the program was able to re-factor that information to design an alternate approach that could still be implemented without serious impact on the program schedule. Actionable Strategies then took a leadership role in implementing the revised approach to remediation.

Business Results

By focusing on the delivery of key business objectives, the client was able to adapt the technology approach. Adapting to an evolving understanding of data quality and the future state that was required to meet these objectives, the bank met internal and regulatory requirements without incident.

Likewise, by focusing on key dependencies and critical risks, the program was able to proactively address challenges and risks to the project plan. The program came within budget and schedule expectations despite constantly emerging challenges.

Based on this highly visible success, the client executive was assigned another large program. He was subsequently recruited away by a competitor to run a key data initiative.